The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th, about a month before the elections. We at Insider Monkey have made an extensive database of more than 817 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded SharpSpring, Inc. (NASDAQ:SHSP) based on those filings.

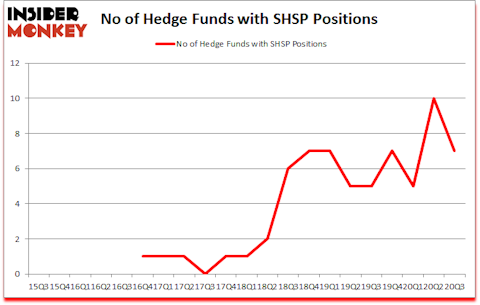

Is SHSP a good stock to buy now? SharpSpring, Inc. (NASDAQ:SHSP) was in 7 hedge funds’ portfolios at the end of September. The all time high for this statistics is 10. SHSP investors should pay attention to a decrease in enthusiasm from smart money lately. There were 10 hedge funds in our database with SHSP positions at the end of the second quarter. Our calculations also showed that SHSP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 5 best cheap stocks to buy according to Ray Dalio to identify stocks with upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s go over the fresh hedge fund action surrounding SharpSpring, Inc. (NASDAQ:SHSP).

How are hedge funds trading SharpSpring, Inc. (NASDAQ:SHSP)?

At the end of September, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of -30% from one quarter earlier. On the other hand, there were a total of 5 hedge funds with a bullish position in SHSP a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, Greenhaven Road Investment Management held the most valuable stake in SharpSpring, Inc. (NASDAQ:SHSP), which was worth $15.2 million at the end of the third quarter. On the second spot was Cat Rock Capital which amassed $12.8 million worth of shares. Portolan Capital Management, Royce & Associates, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Greenhaven Road Investment Management allocated the biggest weight to SharpSpring, Inc. (NASDAQ:SHSP), around 5.85% of its 13F portfolio. Cat Rock Capital is also relatively very bullish on the stock, earmarking 1.33 percent of its 13F equity portfolio to SHSP.

Due to the fact that SharpSpring, Inc. (NASDAQ:SHSP) has experienced bearish sentiment from the smart money, we can see that there were a few money managers who sold off their full holdings in the third quarter. Intriguingly, Josh Goldberg’s G2 Investment Partners Management said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, worth close to $0.5 million in stock, and Donald Sussman’s Paloma Partners was right behind this move, as the fund dropped about $0.2 million worth. These moves are important to note, as total hedge fund interest was cut by 3 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as SharpSpring, Inc. (NASDAQ:SHSP) but similarly valued. We will take a look at Airgain, Inc. (NASDAQ:AIRG), Zovio Inc. (NASDAQ:ZVO), AgroFresh Solutions Inc (NASDAQ:AGFS), MMA Capital Holdings Inc. (NASDAQ:MMAC), Select Bancorp, Inc. (NASDAQ:SLCT), AcelRx Pharmaceuticals Inc (NASDAQ:ACRX), and Platinum Group Metals Limited (NYSE:PLG). This group of stocks’ market valuations are similar to SHSP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AIRG | 8 | 11258 | -2 |

| ZVO | 10 | 32482 | 2 |

| AGFS | 3 | 1438 | -1 |

| MMAC | 3 | 4082 | 0 |

| SLCT | 5 | 10900 | 0 |

| ACRX | 5 | 6850 | 2 |

| PLG | 3 | 3394 | -1 |

| Average | 5.3 | 10058 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.3 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $32 million in SHSP’s case. Zovio Inc. (NASDAQ:ZVO) is the most popular stock in this table. On the other hand AgroFresh Solutions Inc (NASDAQ:AGFS) is the least popular one with only 3 bullish hedge fund positions. SharpSpring, Inc. (NASDAQ:SHSP) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for SHSP is 51.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 31.6% in 2020 through December 2nd and still beat the market by 16 percentage points. Hedge funds were also right about betting on SHSP as the stock returned 53.2% since the end of Q3 (through 12/2) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Sharpspring Inc. (NASDAQ:SHSP)

Follow Sharpspring Inc. (NASDAQ:SHSP)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.