How do we determine whether Senior Housing Properties Trust (NASDAQ:SNH) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

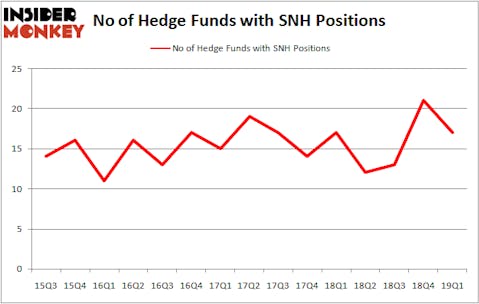

Is Senior Housing Properties Trust (NASDAQ:SNH) undervalued? Hedge funds are getting less optimistic. The number of long hedge fund bets were cut by 4 recently. Our calculations also showed that SNH isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are several methods stock market investors employ to evaluate stocks. A pair of the less utilized methods are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outclass the S&P 500 by a healthy margin (see the details here).

We’re going to take a gander at the fresh hedge fund action encompassing Senior Housing Properties Trust (NASDAQ:SNH).

How have hedgies been trading Senior Housing Properties Trust (NASDAQ:SNH)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SNH over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management, managed by Israel Englander, holds the biggest position in Senior Housing Properties Trust (NASDAQ:SNH). Millennium Management has a $18.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $13 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish comprise Ken Griffin’s Citadel Investment Group, Noam Gottesman’s GLG Partners and John Overdeck and David Siegel’s Two Sigma Advisors.

Because Senior Housing Properties Trust (NASDAQ:SNH) has witnessed a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few hedgies that decided to sell off their full holdings last quarter. It’s worth mentioning that David Costen Haley’s HBK Investments said goodbye to the biggest position of all the hedgies tracked by Insider Monkey, totaling about $0.5 million in call options, and Matthew Hulsizer’s PEAK6 Capital Management was right behind this move, as the fund dropped about $0.4 million worth. These moves are interesting, as total hedge fund interest fell by 4 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Senior Housing Properties Trust (NASDAQ:SNH) but similarly valued. We will take a look at Ormat Technologies, Inc. (NYSE:ORA), Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), Cantel Medical Corp. (NYSE:CMD), and AllianceBernstein Holding LP (NYSE:AB). This group of stocks’ market caps resemble SNH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ORA | 9 | 153748 | 4 |

| AJRD | 15 | 386942 | -4 |

| CMD | 18 | 143681 | 5 |

| AB | 8 | 20311 | 1 |

| Average | 12.5 | 176171 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $176 million. That figure was $69 million in SNH’s case. Cantel Medical Corp. (NYSE:CMD) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 8 bullish hedge fund positions. Senior Housing Properties Trust (NASDAQ:SNH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately SNH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SNH were disappointed as the stock returned -28.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.