While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Senior Housing Properties Trust (NASDAQ:SNH).

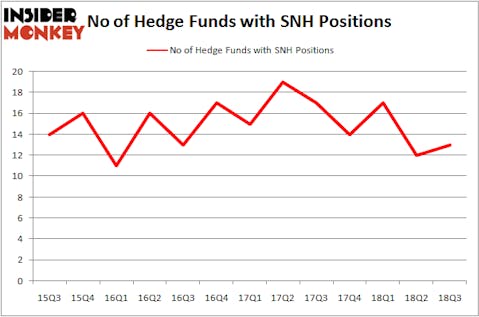

Is Senior Housing Properties Trust (NASDAQ:SNH) the right investment to pursue these days? The best stock pickers are taking an optimistic view. The number of long hedge fund bets went up by 1 lately. Our calculations also showed that SNH isn’t among the 30 most popular stocks among hedge funds. SNH was in 13 hedge funds’ portfolios at the end of the third quarter of 2018. There were 12 hedge funds in our database with SNH positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a look at the fresh hedge fund action encompassing Senior Housing Properties Trust (NASDAQ:SNH).

How are hedge funds trading Senior Housing Properties Trust (NASDAQ:SNH)?

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNH over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Senior Housing Properties Trust (NASDAQ:SNH), which was worth $25.7 million at the end of the third quarter. On the second spot was Millennium Management which amassed $14.5 million worth of shares. Moreover, Two Sigma Advisors, GLG Partners, and Stevens Capital Management were also bullish on Senior Housing Properties Trust (NASDAQ:SNH), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the biggest position in Senior Housing Properties Trust (NASDAQ:SNH). Balyasny Asset Management had $0.5 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.3 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks similar to Senior Housing Properties Trust (NASDAQ:SNH). We will take a look at Texas Capital Bancshares Inc (NASDAQ:TCBI), GDS Holdings Limited (NASDAQ:GDS), On ASGN Incorporated (NYSE:ASGN), and Vipshop Holdings Limited (NYSE:VIPS). All of these stocks’ market caps are similar to SNH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCBI | 22 | 513914 | 5 |

| GDS | 26 | 670834 | 7 |

| ASGN | 18 | 70864 | 4 |

| VIPS | 22 | 130110 | -5 |

| Average | 22 | 346431 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $346 million. That figure was $66 million in SNH’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand On ASGN Incorporated (NYSE:ASGN) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Senior Housing Properties Trust (NASDAQ:SNH) is even less popular than ASGN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.