In this article you are going to find out whether hedge funds think salesforce.com, inc. (NYSE:CRM) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

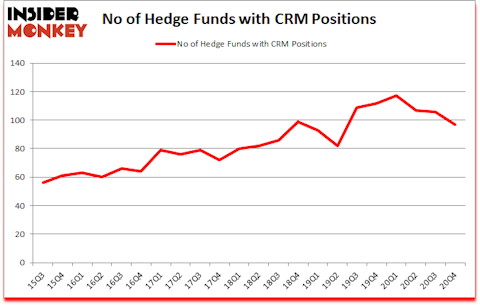

Is CRM stock a buy or sell? salesforce.com, inc. (NYSE:CRM) shareholders have witnessed a decrease in enthusiasm from smart money recently. salesforce.com, inc. (NYSE:CRM) was in 97 hedge funds’ portfolios at the end of December. The all time high for this statistic is 117. Our calculations also showed that CRM ranked 24th among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 197% since March 2017 and outperformed the S&P 500 ETFs by more than 124 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Richard Gerson of Falcon Edge Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. Recently Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best biotech stocks to invest in to pick the next stock that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). With all of this in mind let’s go over the new hedge fund action encompassing salesforce.com, inc. (NYSE:CRM).

Do Hedge Funds Think CRM Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 97 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CRM over the last 22 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Ken Fisher’s Fisher Asset Management has the number one position in salesforce.com, inc. (NYSE:CRM), worth close to $2.7799 billion, amounting to 2.1% of its total 13F portfolio. The second largest stake is held by Masayoshi Son of SB Management, with a $676.9 million position; 3.8% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that are bullish consist of Brad Gerstner’s Altimeter Capital Management, David Goel and Paul Ferri’s Matrix Capital Management and Chase Coleman’s Tiger Global Management LLC. In terms of the portfolio weights assigned to each position Greenlea Lane Capital allocated the biggest weight to salesforce.com, inc. (NYSE:CRM), around 15.04% of its 13F portfolio. ROAM Global Management is also relatively very bullish on the stock, setting aside 14.83 percent of its 13F equity portfolio to CRM.

Since salesforce.com, inc. (NYSE:CRM) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few fund managers that decided to sell off their full holdings heading into Q1. At the top of the heap, Robert Pitts’s Steadfast Capital Management sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $178.3 million in stock, and Ryan Frick and Oliver Evans’s Dorsal Capital Management was right behind this move, as the fund dropped about $118.1 million worth. These moves are important to note, as aggregate hedge fund interest was cut by 9 funds heading into Q1.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as salesforce.com, inc. (NYSE:CRM) but similarly valued. We will take a look at Intel Corporation (NASDAQ:INTC), Abbott Laboratories (NYSE:ABT), Oracle Corporation (NASDAQ:ORCL), AbbVie Inc (NYSE:ABBV), Cisco Systems, Inc. (NASDAQ:CSCO), Thermo Fisher Scientific Inc. (NYSE:TMO), and Broadcom Inc (NASDAQ:AVGO). This group of stocks’ market values match CRM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INTC | 72 | 5578824 | 6 |

| ABT | 64 | 4303482 | 2 |

| ORCL | 52 | 2450210 | -4 |

| ABBV | 83 | 6965013 | 1 |

| CSCO | 60 | 4974309 | 1 |

| TMO | 89 | 5470797 | 9 |

| AVGO | 59 | 3342445 | 0 |

| Average | 68.4 | 4726440 | 2.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 68.4 hedge funds with bullish positions and the average amount invested in these stocks was $4726 million. That figure was $10576 million in CRM’s case. Thermo Fisher Scientific Inc. (NYSE:TMO) is the most popular stock in this table. On the other hand Oracle Corporation (NASDAQ:ORCL) is the least popular one with only 52 bullish hedge fund positions. Compared to these stocks salesforce.com, inc. (NYSE:CRM) is more popular among hedge funds. Our overall hedge fund sentiment score for CRM is 70.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Unfortunately CRM wasn’t nearly as successful as these 30 stocks and hedge funds that were betting on CRM were disappointed as the stock returned -4.6% since the end of the fourth quarter (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the more diversified list of the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Salesforce Inc. (NYSE:CRM)

Follow Salesforce Inc. (NYSE:CRM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.