Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Red Lion Hotels Corporation (NYSE:RLH) from the perspective of those elite funds.

Red Lion Hotels Corporation (NYSE:RLH) has seen a decrease in activity from the world’s largest hedge funds of late. Our calculations also showed that RLH isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as underperforming, old investment tools of years past. While there are more than 8000 funds with their doors open at the moment, Our researchers look at the masters of this group, approximately 750 funds. It is estimated that this group of investors watch over most of all hedge funds’ total capital, and by shadowing their top stock picks, Insider Monkey has formulated a few investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a look at the new hedge fund action surrounding Red Lion Hotels Corporation (NYSE:RLH).

Hedge fund activity in Red Lion Hotels Corporation (NYSE:RLH)

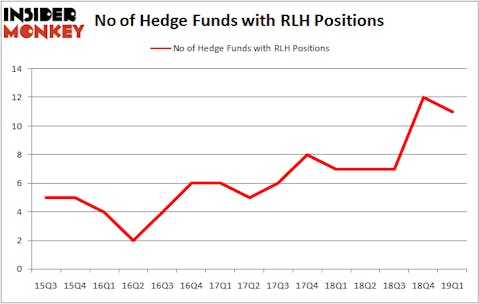

Heading into the second quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from the previous quarter. The graph below displays the number of hedge funds with bullish position in RLH over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Coliseum Capital held the most valuable stake in Red Lion Hotels Corporation (NYSE:RLH), which was worth $29.6 million at the end of the first quarter. On the second spot was Royce & Associates which amassed $7.7 million worth of shares. Moreover, Manatuck Hill Partners, Portolan Capital Management, and Rutabaga Capital Management were also bullish on Red Lion Hotels Corporation (NYSE:RLH), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Red Lion Hotels Corporation (NYSE:RLH) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of money managers that elected to cut their full holdings last quarter. Intriguingly, Bradley LouisáRadoff’s Fondren Management dumped the biggest position of all the hedgies monitored by Insider Monkey, valued at close to $0.4 million in stock. Israel Englander’s fund, Millennium Management, also sold off its stock, about $0.3 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 1 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Red Lion Hotels Corporation (NYSE:RLH). These stocks are NII Holdings, Inc. (NASDAQ:NIHD), Catasys, Inc. (NASDAQ:CATS), ASA Gold and Precious Metals Ltd (NYSE:ASA), and Saga Communications, Inc. (NASDAQ:SGA). All of these stocks’ market caps are similar to RLH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NIHD | 14 | 40636 | -4 |

| CATS | 6 | 2276 | 5 |

| ASA | 5 | 13600 | 0 |

| SGA | 3 | 26728 | 1 |

| Average | 7 | 20810 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $21 million. That figure was $58 million in RLH’s case. NII Holdings, Inc. (NASDAQ:NIHD) is the most popular stock in this table. On the other hand Saga Communications, Inc. (NASDAQ:SGA) is the least popular one with only 3 bullish hedge fund positions. Red Lion Hotels Corporation (NYSE:RLH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately RLH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on RLH were disappointed as the stock returned -8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.