Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

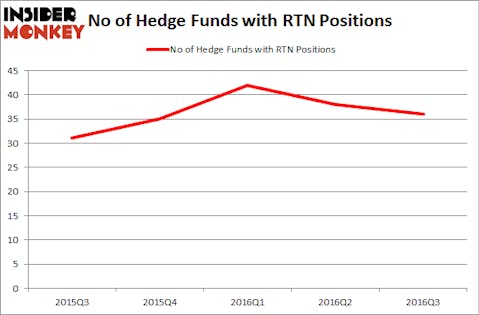

Raytheon Company (NYSE:RTN) shareholders have witnessed a decrease in support from the world’s most elite money managers lately. RTN was in 36 hedge funds’ portfolios at the end of the third quarter of 2016. There were 38 hedge funds in our database with RTN holdings at the end of the previous quarter. At the end of this article we will also compare RTN to other stocks including Northrop Grumman Corporation (NYSE:NOC), ING Groep N.V. (ADR) (NYSE:ING), and Enbridge Inc (USA) (NYSE:ENB) to get a better sense of its popularity.

Follow Raytheon Co (NYSE:RTN)

Follow Raytheon Co (NYSE:RTN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Arina P Habich/Shutterstock.com

Now, we’re going to take a look at the latest action encompassing Raytheon Company (NYSE:RTN).

What have hedge funds been doing with Raytheon Company (NYSE:RTN)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 5% drop from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the number one position in Raytheon Company (NYSE:RTN). The fund has a $357 million position in the stock, comprising 0.5% of its 13F portfolio. The second most bullish fund manager is Israel Englander of Millennium Management, with a $131 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions include D. E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors and Ken Griffin’s Citadel Investment Group.

Seeing as Raytheon Company (NYSE:RTN) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there exists a select few funds that elected to cut their full holdings by the end of the third quarter. Intriguingly, Jean-Marie Eveillard’s First Eagle Investment Management sold off the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling about $157.8 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also sold off its stock, about $47.4 million worth of RTN shares. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Raytheon Company (NYSE:RTN). We will take a look at Northrop Grumman Corporation (NYSE:NOC), ING Groep N.V. (ADR) (NYSE:ING), Enbridge Inc (USA) (NYSE:ENB), and Netflix, Inc. (NASDAQ:NFLX). This group of stocks’ market values are closest to RTN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NOC | 37 | 1229934 | -7 |

| ING | 12 | 58872 | -2 |

| ENB | 21 | 286488 | 6 |

| NFLX | 55 | 3711921 | 1 |

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1.32 billion. That figure was $1.04 billion in RTN’s case. Netflix, Inc. (NASDAQ:NFLX) is the most popular stock in this table. On the other hand ING Groep N.V. (ADR) (NYSE:ING) is the least popular one with only 12 bullish hedge fund positions. Raytheon Company (NYSE:RTN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NFLX might be a better candidate to consider a long position.

Disclosure: none.