In this article we will analyze whether Range Resources Corp. (NYSE:RRC) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

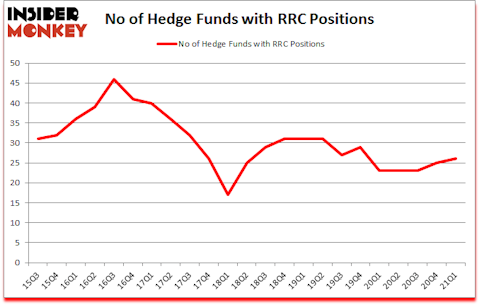

Is RRC a good stock to buy? Range Resources Corp. (NYSE:RRC) investors should pay attention to an increase in hedge fund sentiment in recent months. Range Resources Corp. (NYSE:RRC) was in 26 hedge funds’ portfolios at the end of March. The all time high for this statistic is 46. Our calculations also showed that RRC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the 21st century investor’s toolkit there are a large number of signals shareholders put to use to size up their holdings. Two of the best signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can trounce the broader indices by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, economists warn of inflation flare up. So, we are checking out this backdoor gold play that has hit peak gains of 718% in a little over a year. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s review the recent hedge fund action encompassing Range Resources Corp. (NYSE:RRC).

Do Hedge Funds Think RRC Is A Good Stock To Buy Now?

At first quarter’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in RRC over the last 23 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, SailingStone Capital Partners was the largest shareholder of Range Resources Corp. (NYSE:RRC), with a stake worth $132 million reported as of the end of March. Trailing SailingStone Capital Partners was Kopernik Global Investors, which amassed a stake valued at $83.3 million. D E Shaw, Contrarius Investment Management, and Fisher Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position SailingStone Capital Partners allocated the biggest weight to Range Resources Corp. (NYSE:RRC), around 30.86% of its 13F portfolio. Kopernik Global Investors is also relatively very bullish on the stock, dishing out 9.38 percent of its 13F equity portfolio to RRC.

Consequently, specific money managers have been driving this bullishness. Water Street Capital, managed by Gilchrist Berg, established the most outsized position in Range Resources Corp. (NYSE:RRC). Water Street Capital had $3.1 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $1.7 million position during the quarter. The following funds were also among the new RRC investors: Kenneth Tropin’s Graham Capital Management, Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital), and Charles Davidson and Joseph Jacobs’s Wexford Capital.

Let’s also examine hedge fund activity in other stocks similar to Range Resources Corp. (NYSE:RRC). We will take a look at Allegheny Technologies Incorporated (NYSE:ATI), SPX FLOW, Inc. (NYSE:FLOW), Broadstone Net Lease, Inc. (NYSE:BNL), Main Street Capital Corporation (NYSE:MAIN), Sunoco LP (NYSE:SUN), Surgery Partners, Inc. (NASDAQ:SGRY), and Plexus Corp. (NASDAQ:PLXS). This group of stocks’ market values resemble RRC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATI | 20 | 294940 | -7 |

| FLOW | 16 | 193826 | 4 |

| BNL | 9 | 26568 | -2 |

| MAIN | 10 | 33906 | 3 |

| SUN | 2 | 821 | -1 |

| SGRY | 10 | 139528 | -5 |

| PLXS | 14 | 75816 | -3 |

| Average | 11.6 | 109344 | -1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.6 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $415 million in RRC’s case. Allegheny Technologies Incorporated (NYSE:ATI) is the most popular stock in this table. On the other hand Sunoco LP (NYSE:SUN) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Range Resources Corp. (NYSE:RRC) is more popular among hedge funds. Our overall hedge fund sentiment score for RRC is 73. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 24% in 2021 through July 9th but still managed to beat the market by 6.7 percentage points. Hedge funds were also right about betting on RRC as the stock returned 64% since the end of March (through 7/9) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Range Resources Corp (NYSE:RRC)

Follow Range Resources Corp (NYSE:RRC)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 15 Best Luxury Hotels in the World

- 10 Most Profitable Industries in the US

Disclosure: None. This article was originally published at Insider Monkey.