In this article we will take a look at whether hedge funds think QUALCOMM, Incorporated (NASDAQ:QCOM) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

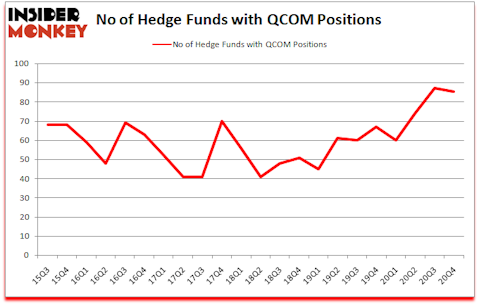

Is QUALCOMM (QCOM) stock a buy or sell? The best stock pickers were becoming less hopeful. The number of bullish hedge fund bets retreated by 2 recently. QUALCOMM, Incorporated (NASDAQ:QCOM) was in 85 hedge funds’ portfolios at the end of December. The all time high for this statistic is 87. Our calculations also showed that QCOM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here).

David Tepper of Appaloosa Management LP

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 best cheap stocks to buy now to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage (or at the end of this article). With all of this in mind we’re going to take a glance at the new hedge fund action encompassing QUALCOMM, Incorporated (NASDAQ:QCOM).

Do Hedge Funds Think QCOM Is A Good Stock To Buy Now?

At the end of the fourth quarter, a total of 85 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from one quarter earlier. By comparison, 67 hedge funds held shares or bullish call options in QCOM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Matrix Capital Management held the most valuable stake in QUALCOMM, Incorporated (NASDAQ:QCOM), which was worth $508.4 million at the end of the fourth quarter. On the second spot was Polar Capital which amassed $220.6 million worth of shares. Adage Capital Management, Millennium Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Think Investments allocated the biggest weight to QUALCOMM, Incorporated (NASDAQ:QCOM), around 6.04% of its 13F portfolio. Tiger Management is also relatively very bullish on the stock, designating 5.65 percent of its 13F equity portfolio to QCOM.

Due to the fact that QUALCOMM, Incorporated (NASDAQ:QCOM) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of fund managers that slashed their entire stakes in the fourth quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the biggest stake of the 750 funds tracked by Insider Monkey, worth close to $61.4 million in stock, and Brandon Haley’s Holocene Advisors was right behind this move, as the fund sold off about $34.1 million worth. These transactions are important to note, as total hedge fund interest fell by 2 funds in the fourth quarter.

Let’s go over hedge fund activity in other stocks similar to QUALCOMM, Incorporated (NASDAQ:QCOM). We will take a look at T-Mobile US, Inc. (NASDAQ:TMUS), Costco Wholesale Corporation (NASDAQ:COST), BHP Group (NYSE:BHP), Novo Nordisk A/S (NYSE:NVO), Chevron Corporation (NYSE:CVX), Eli Lilly and Company (NYSE:LLY), and McDonald’s Corporation (NYSE:MCD). All of these stocks’ market caps match QCOM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMUS | 103 | 9117019 | 9 |

| COST | 61 | 3613961 | -12 |

| BHP | 20 | 1099946 | 2 |

| NVO | 23 | 3161939 | 1 |

| CVX | 50 | 5390278 | 7 |

| LLY | 50 | 3028302 | -10 |

| MCD | 62 | 2889876 | -3 |

| Average | 52.7 | 4043046 | -0.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 52.7 hedge funds with bullish positions and the average amount invested in these stocks was $4043 million. That figure was $2728 million in QCOM’s case. T-Mobile US, Inc. (NASDAQ:TMUS) is the most popular stock in this table. On the other hand BHP Group (NYSE:BHP) is the least popular one with only 20 bullish hedge fund positions. QUALCOMM, Incorporated (NASDAQ:QCOM) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for QCOM is 71.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 7% in 2021 through March 12th and beat the market again by 1.6 percentage points. Unfortunately QCOM wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on QCOM were disappointed as the stock returned -14.3% since the end of December (through 3/12) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Qualcomm Inc (NASDAQ:QCOM)

Follow Qualcomm Inc (NASDAQ:QCOM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.