Donald Trump’s election victory pushed the markets higher due to expectations of lower taxes, higher growth and higher interested rates. Lower taxes and higher GDP growth rates are good for almost all companies but the expectations of higher interest rates have been hurting low volatility and dividend stocks. Many investors, including Carl Icahn or Stan Druckenmiller, have been saying for a while now that Trump presidency will be good for publicly traded stocks (at least in the very short term) due to lower taxes and higher GDP growth rates. Both investors profited handsomely from this analysis during the 5 hours immediately following Donald Trump’s election victory. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is PPL Corp (NYSE:PPL), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

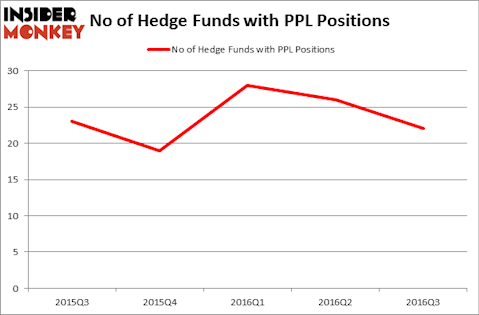

Is PPL Corp (NYSE:PPL) going to take off soon? Investors who are in the know are getting less bullish. The number of long hedge fund positions dropped by 4 in recent months. PPL was in 22 hedge funds’ portfolios at the end of the third quarter of 2016. There were 26 hedge funds in our database with PPL positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Deere & Company (NYSE:DE), Cardinal Health, Inc. (NYSE:CAH), and Edison International (NYSE:EIX) to gather more data points.

Follow Ppl Corp (NYSE:PPL)

Follow Ppl Corp (NYSE:PPL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

patpitchaya/Shutterstock.com

Keeping this in mind, let’s analyze the new action surrounding PPL Corp (NYSE:PPL).

Hedge fund activity in PPL Corp (NYSE:PPL)

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the previous quarter. So, let’s see which hedge fund managers were among the top holders and which hedge fund managers were selling out.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Israel Englander’s Millennium Management has the largest position in PPL Corp (NYSE:PPL), worth close to $154.2 million, corresponding to 0.3% of its total 13F portfolio. The second largest stake is held by Jonathan Barrett and Paul Segal of Luminus Management, with a $110.5 million position; the fund has 2.8% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism contain Cliff Asness’s AQR Capital Management, Jim Simons’s Renaissance Technologies and Stuart J. Zimmer’s Zimmer Partners.