Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Potbelly Corp (NASDAQ:PBPB).

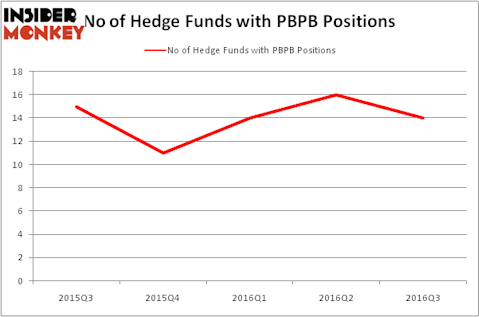

Potbelly Corp (NASDAQ:PBPB) has experienced a decrease in hedge fund sentiment recently. 14 hedge funds that we track were long the stock on September 30. There were 16 hedge funds in our database with PBPB holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as NewLink Genetics Corp (NASDAQ:NLNK), Versartic Inc (NASDAQ:VSAR), and Casella Waste Systems Inc. (NASDAQ:CWST) to gather more data points.

Follow Potbelly Corp (NASDAQ:PBPB)

Follow Potbelly Corp (NASDAQ:PBPB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

What does the smart money think about Potbelly Corp (NASDAQ:PBPB)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a 13% dip from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PBPB over the last 5 quarters, which has been somewhat volatile. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, founded by Jim Simons, holds the most valuable position in Potbelly Corp (NASDAQ:PBPB). Renaissance Technologies has a $23.4 million position in the stock. The second most bullish fund manager is Peter Algert and Kevin Coldiron of Algert Coldiron Investors, with a $1.8 million position. Some other peers that are bullish include John Overdeck and David Siegel’s Two Sigma Advisors, Adam Wright and Gary Kohler’s Blue Clay Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Potbelly Corp (NASDAQ:PBPB) has sustained a decline in interest from hedge fund managers, logic holds that there were a few hedgies that decided to sell off their full holdings last quarter. At the top of the heap, Sahm Adrangi’s Kerrisdale Capital dumped the largest position of the 700 funds studied by Insider Monkey, valued at close to $1.2 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund sold off about $0.4 million worth of shares.

Let’s now take a look at hedge fund activity in other stocks similar to Potbelly Corp (NASDAQ:PBPB). These stocks are NewLink Genetics Corp (NASDAQ:NLNK), Versartic Inc (NASDAQ:VSAR), Casella Waste Systems Inc. (NASDAQ:CWST), and NMI Holdings Inc (NASDAQ:NMIH). This group of stocks’ market valuations match PBPB’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NLNK | 12 | 52368 | -1 |

| VSAR | 15 | 123488 | 9 |

| CWST | 18 | 101181 | 3 |

| NMIH | 21 | 145771 | 4 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $35 million in PBPB’s case. NMI Holdings Inc (NASDAQ:NMIH) is the most popular stock in this table. On the other hand NewLink Genetics Corp (NASDAQ:NLNK) is the least popular one with only 12 bullish hedge fund positions. Potbelly Corp (NASDAQ:PBPB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NMIH might be a better candidate to consider taking a long position in.

Disclosure: None