You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

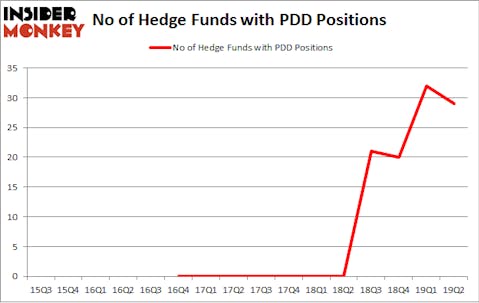

Is Pinduoduo Inc. (NASDAQ:PDD) a healthy stock for your portfolio? The best stock pickers are turning less bullish. The number of long hedge fund bets went down by 3 recently. Our calculations also showed that PDD isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are assumed to be underperforming, old financial tools of yesteryear. While there are over 8000 funds with their doors open today, Our researchers hone in on the bigwigs of this club, approximately 750 funds. It is estimated that this group of investors orchestrate the majority of the smart money’s total capital, and by observing their best picks, Insider Monkey has identified a number of investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Brad Gerstner of Altimeter Capital

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action encompassing Pinduoduo Inc. (NASDAQ:PDD).

Hedge fund activity in Pinduoduo Inc. (NASDAQ:PDD)

At Q2’s end, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in PDD a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Altimeter Capital Management was the largest shareholder of Pinduoduo Inc. (NASDAQ:PDD), with a stake worth $125.3 million reported as of the end of March. Trailing Altimeter Capital Management was Sylebra Capital Management, which amassed a stake valued at $72.2 million. Renaissance Technologies, Hillhouse Capital Management, and SCGE Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Pinduoduo Inc. (NASDAQ:PDD) has faced declining sentiment from the smart money, we can see that there lies a certain “tier” of hedge funds that slashed their entire stakes in the second quarter. At the top of the heap, Larry Chen and Terry Zhang’s Tairen Capital sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $94.3 million in stock. Kerr Neilson’s fund, Platinum Asset Management, also dumped its stock, about $39.3 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 3 funds in the second quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Pinduoduo Inc. (NASDAQ:PDD) but similarly valued. These stocks are TAL Education Group (NYSE:TAL), United Airlines Holdings, Inc. (NASDAQ:UAL), Archer-Daniels-Midland Company (NYSE:ADM), and M&T Bank Corporation (NYSE:MTB). This group of stocks’ market values match PDD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TAL | 25 | 1185511 | 0 |

| UAL | 47 | 6715542 | -2 |

| ADM | 26 | 473693 | 1 |

| MTB | 31 | 1264574 | -5 |

| Average | 32.25 | 2409830 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.25 hedge funds with bullish positions and the average amount invested in these stocks was $2410 million. That figure was $459 million in PDD’s case. United Airlines Holdings, Inc. (NASDAQ:UAL) is the most popular stock in this table. On the other hand TAL Education Group (NYSE:TAL) is the least popular one with only 25 bullish hedge fund positions. Pinduoduo Inc. (NASDAQ:PDD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on PDD as the stock returned 56.2% during the same time frame and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.