Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Phoenix New Media Limited (NYSE:FENG) to find out whether it was one of their high conviction long-term ideas.

Hedge fund interest in Phoenix New Media Limited (NYSE:FENG) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as American National BankShares Inc (NASDAQ:AMNB), Urovant Sciences Ltd. (NASDAQ:UROV), and Energy Fuels Inc. (NYSE:UUUU) to gather more data points.

In today’s marketplace there are numerous metrics investors can use to size up publicly traded companies. A pair of the less known metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the elite fund managers can outperform the broader indices by a healthy margin (see the details here).

We’re going to take a peek at the key hedge fund action surrounding Phoenix New Media Limited (NYSE:FENG).

How are hedge funds trading Phoenix New Media Limited (NYSE:FENG)?

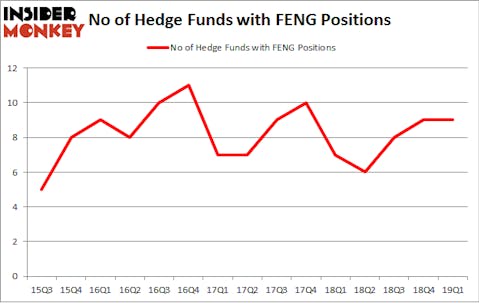

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2018. By comparison, 7 hedge funds held shares or bullish call options in FENG a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Charles de Vaulx’s International Value Advisers has the most valuable position in Phoenix New Media Limited (NYSE:FENG), worth close to $17.6 million, corresponding to 0.7% of its total 13F portfolio. The second largest stake is held by Park West Asset Management, led by Peter S. Park, holding a $6.7 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other peers with similar optimism contain Daniel Patrick Gibson’s Sylebra Capital Management, Jim Simons’s Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors.

Seeing as Phoenix New Media Limited (NYSE:FENG) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their positions entirely in the third quarter. Interestingly, Israel Englander’s Millennium Management sold off the largest stake of the “upper crust” of funds watched by Insider Monkey, worth about $0.3 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dumped its stock, about $0.1 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Phoenix New Media Limited (NYSE:FENG) but similarly valued. These stocks are American National BankShares Inc (NASDAQ:AMNB), Urovant Sciences Ltd. (NASDAQ:UROV), Energy Fuels Inc. (NYSE:UUUU), and Denison Mines Corp (NYSE:DNN). This group of stocks’ market values are closest to FENG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMNB | 2 | 7542 | -1 |

| UROV | 9 | 37464 | -3 |

| UUUU | 7 | 14766 | -2 |

| DNN | 4 | 1427 | 0 |

| Average | 5.5 | 15300 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $15 million. That figure was $33 million in FENG’s case. Urovant Sciences Ltd. (NASDAQ:UROV) is the most popular stock in this table. On the other hand American National BankShares Inc (NASDAQ:AMNB) is the least popular one with only 2 bullish hedge fund positions. Phoenix New Media Limited (NYSE:FENG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FENG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FENG were disappointed as the stock returned -17.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.