Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: PHI Inc. (NASDAQ:PHIIK).

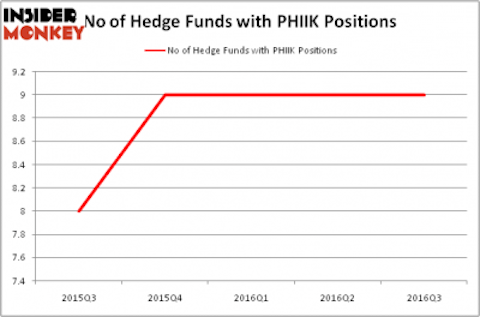

PHI Inc. (NASDAQ:PHIIK) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Collegium Pharmaceutical Inc (NASDAQ:COLL), IntelSat SA (NYSE:I), and Advaxis, Inc. (NASDAQ:ADXS) to gather more data points.

Follow Phi Inc (NASDAQ:PHIKQ)

Follow Phi Inc (NASDAQ:PHIKQ)

Receive real-time insider trading and news alerts

In the eyes of most traders, hedge funds are viewed as slow, old investment vehicles of yesteryear. While there are more than 8000 funds in operation at present, We look at the elite of this group, around 700 funds. These hedge fund managers administer the majority of the smart money’s total capital, and by tracking their inimitable stock picks, Insider Monkey has identified numerous investment strategies that have historically outstripped the market. Insider Monkey’s small-cap hedge fund strategy outperformed the S&P 500 index by 12 percentage points per year for a decade in our back tests.

dade72/Shutterstock.com

With all of this in mind, we’re going to take a gander at the key action regarding PHI Inc. (NASDAQ:PHIIK).

How have hedgies been trading PHI Inc. (NASDAQ:PHIIK)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, West Face Capital, managed by Greg Boland, holds the number one position in PHI Inc. (NASDAQ:PHIIK). West Face Capital has a $58.4 million position in the stock, comprising 33.4% of its 13F portfolio. It has a lot riding on this stock. The second largest stake is held by David Brown of Hawk Ridge Management, with a $10.7 million position; the fund has 5.8% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish encompass Jim Simons’s Renaissance Technologies, D. E. Shaw’s D E Shaw and Charles Paquelet’s Skylands Capital.

Of course not everyone in the hedge fund community is bullish about the stock. There are a select few hedgies who sold off their entire stakes by the end of the third quarter. At the top of the heap, Michael Doheny’s Freshford Capital Management sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, worth an estimated $3.6 million in stock, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors was right behind this move, as the fund sold off a small position of about $0.3 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as PHI Inc. (NASDAQ:PHIIK) but similarly valued. We will take a look at Collegium Pharmaceutical Inc (NASDAQ:COLL), IntelSat SA (NYSE:I), Advaxis, Inc. (NASDAQ:ADXS), and Digi International Inc. (NASDAQ:DGII). This group of stocks’ market caps resemble PHIIK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COLL | 10 | 140212 | -2 |

| I | 15 | 92302 | 1 |

| ADXS | 14 | 116264 | -3 |

| DGII | 15 | 21063 | -1 |

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $77 million in PHIIK’s case. IntelSat SA (NYSE:I) is the most popular stock in this table. On the other hand Collegium Pharmaceutical Inc (NASDAQ:COLL) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks PHI Inc. (NASDAQ:PHIIK) is even less popular than COLL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.