While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus spending, many smart money investors are starting to get cautious towards the current bull run since March, 2020 and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Paypal Holdings Inc (NASDAQ:PYPL).

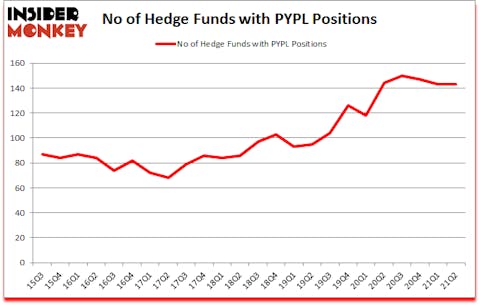

Paypal Holdings Inc (NASDAQ:PYPL) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 143 hedge funds’ portfolios at the end of the second quarter of 2021. Our calculations also showed that PYPL ranked 10th among the 30 most popular stocks among hedge funds (click for Q2 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as The Home Depot, Inc. (NYSE:HD), The Procter & Gamble Company (NYSE:PG), and The Walt Disney Company (NYSE:DIS) to gather more data points.

To the average investor there are many indicators investors employ to assess stocks. A duo of the best indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outclass the broader indices by a significant margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s check out the new hedge fund action encompassing Paypal Holdings Inc (NASDAQ:PYPL).

Do Hedge Funds Think PYPL Is A Good Stock To Buy Now?

At second quarter’s end, a total of 143 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in PYPL over the last 24 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Paypal Holdings Inc (NASDAQ:PYPL) was held by Fundsmith LLP, which reported holding $3582.1 million worth of stock at the end of June. It was followed by Fisher Asset Management with a $3374.4 million position. Other investors bullish on the company included Coatue Management, Citadel Investment Group, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Aravt Global allocated the biggest weight to Paypal Holdings Inc (NASDAQ:PYPL), around 17.05% of its 13F portfolio. Ogborne Capital is also relatively very bullish on the stock, dishing out 16.22 percent of its 13F equity portfolio to PYPL.

Judging by the fact that Paypal Holdings Inc (NASDAQ:PYPL) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of funds that slashed their entire stakes in the second quarter. It’s worth mentioning that Robert Pitts’s Steadfast Capital Management cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, worth close to $145.9 million in stock. Josh Resnick’s fund, Jericho Capital Asset Management, also said goodbye to its stock, about $116.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Paypal Holdings Inc (NASDAQ:PYPL). We will take a look at The Home Depot, Inc. (NYSE:HD), The Procter & Gamble Company (NYSE:PG), The Walt Disney Company (NYSE:DIS), ASML Holding N.V. (NASDAQ:ASML), Adobe Inc. (NASDAQ:ADBE), Exxon Mobil Corporation (NYSE:XOM), and Comcast Corporation (NASDAQ:CMCSA). This group of stocks’ market valuations match PYPL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HD | 64 | 4177204 | -4 |

| PG | 68 | 6934291 | -2 |

| DIS | 112 | 10830152 | -22 |

| ASML | 44 | 4323106 | 9 |

| ADBE | 89 | 13101408 | -18 |

| XOM | 68 | 3698096 | 3 |

| CMCSA | 84 | 9300743 | -4 |

| Average | 75.6 | 7480714 | -5.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 75.6 hedge funds with bullish positions and the average amount invested in these stocks was $7481 million. That figure was $16353 million in PYPL’s case. The Walt Disney Company (NYSE:DIS) is the most popular stock in this table. On the other hand ASML Holding N.V. (NASDAQ:ASML) is the least popular one with only 44 bullish hedge fund positions. Compared to these stocks Paypal Holdings Inc (NASDAQ:PYPL) is more popular among hedge funds. Our overall hedge fund sentiment score for PYPL is 94.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.1% in 2021 through September 20th and still beat the market by 6.9 percentage points. Unfortunately PYPL wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on PYPL were disappointed as the stock returned -7.4% since the end of the second quarter (through 9/20) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Paypal Holdings Inc. (NASDAQ:PYPL)

Follow Paypal Holdings Inc. (NASDAQ:PYPL)

Receive real-time insider trading and news alerts

Suggested Articles:

- George Soros’ Top 10 Stock Picks

- Top 10 Undervalued Tech Stocks

- Short Seller Jim Chanos’ Top 10 Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.