The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Par Pacific Holdings, Inc. (NYSE:PARR).

Hedge fund interest in Par Pacific Holdings, Inc. (NYSE:PARR) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare PARR to other stocks including Mercer International Inc. (NASDAQ:MERC), Solar Capital Ltd. (NASDAQ:SLRC), and Social Capital Hedosophia Holdings Corp. (NYSE:IPOA) to get a better sense of its popularity.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Andy Redleaf of Whitebox Advisors

Let’s take a peek at the new hedge fund action encompassing Par Pacific Holdings, Inc. (NYSE:PARR).

Hedge fund activity in Par Pacific Holdings, Inc. (NYSE:PARR)

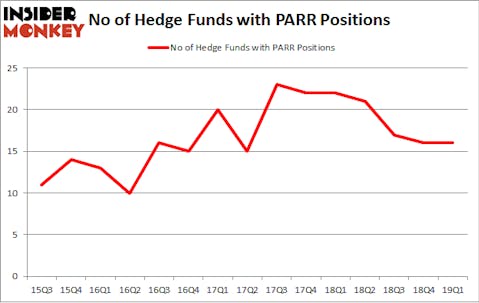

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards PARR over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Among these funds, Whitebox Advisors held the most valuable stake in Par Pacific Holdings, Inc. (NYSE:PARR), which was worth $38.3 million at the end of the first quarter. On the second spot was Park West Asset Management which amassed $30.1 million worth of shares. Moreover, Birch Run Capital, Renaissance Technologies, and Omega Advisors were also bullish on Par Pacific Holdings, Inc. (NYSE:PARR), allocating a large percentage of their portfolios to this stock.

Due to the fact that Par Pacific Holdings, Inc. (NYSE:PARR) has faced a decline in interest from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds that decided to sell off their full holdings heading into Q3. It’s worth mentioning that Peter Algert and Kevin Coldiron’s Algert Coldiron Investors cut the largest stake of all the hedgies monitored by Insider Monkey, comprising an estimated $1.8 million in stock, and Marc Majzner’s Clearline Capital was right behind this move, as the fund said goodbye to about $0.2 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Par Pacific Holdings, Inc. (NYSE:PARR) but similarly valued. These stocks are Mercer International Inc. (NASDAQ:MERC), Solar Capital Ltd. (NASDAQ:SLRC), Social Capital Hedosophia Holdings Corp. (NYSE:IPOA), and Qiwi PLC (NASDAQ:QIWI). This group of stocks’ market valuations are closest to PARR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MERC | 14 | 141114 | -2 |

| SLRC | 11 | 60312 | -1 |

| IPOA | 22 | 283400 | 1 |

| QIWI | 12 | 77832 | 4 |

| Average | 14.75 | 140665 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $110 million in PARR’s case. Social Capital Hedosophia Holdings Corp. (NYSE:IPOA) is the most popular stock in this table. On the other hand Solar Capital Ltd. (NASDAQ:SLRC) is the least popular one with only 11 bullish hedge fund positions. Par Pacific Holdings, Inc. (NYSE:PARR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on PARR as the stock returned 11.6% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.