The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Overseas Shipholding Group, Inc. (NYSE:OSG) based on those filings.

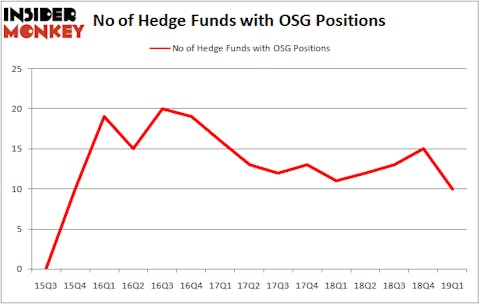

Overseas Shipholding Group, Inc. (NYSE:OSG) has experienced a decrease in hedge fund interest recently. OSG was in 10 hedge funds’ portfolios at the end of March. There were 15 hedge funds in our database with OSG holdings at the end of the previous quarter. Our calculations also showed that OSG isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a glance at the fresh hedge fund action surrounding Overseas Shipholding Group, Inc. (NYSE:OSG).

How have hedgies been trading Overseas Shipholding Group, Inc. (NYSE:OSG)?

At Q1’s end, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in OSG over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Overseas Shipholding Group, Inc. (NYSE:OSG) was held by Cyrus Capital Partners, which reported holding $20.4 million worth of stock at the end of March. It was followed by AQR Capital Management with a $7.6 million position. Other investors bullish on the company included Strategic Value Partners, Renaissance Technologies, and D E Shaw.

Since Overseas Shipholding Group, Inc. (NYSE:OSG) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there were a few money managers who sold off their full holdings by the end of the third quarter. Interestingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dumped the biggest investment of all the hedgies monitored by Insider Monkey, worth close to $13.1 million in stock. Bruce Kovner’s fund, Caxton Associates LP, also cut its stock, about $3.9 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 5 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Overseas Shipholding Group, Inc. (NYSE:OSG) but similarly valued. These stocks are LF Capital Acquisition Corp. (NASDAQ:LFAC), Adamas Pharmaceuticals Inc (NASDAQ:ADMS), Nuvectra Corporation (NASDAQ:NVTR), and Millendo Therapeutics, Inc. (NASDAQ:MLND). This group of stocks’ market values match OSG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LFAC | 10 | 33730 | 0 |

| ADMS | 11 | 60975 | -1 |

| NVTR | 12 | 25571 | -4 |

| MLND | 9 | 48888 | 2 |

| Average | 10.5 | 42291 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $42 million. That figure was $43 million in OSG’s case. Nuvectra Corporation (NASDAQ:NVTR) is the most popular stock in this table. On the other hand Millendo Therapeutics, Inc. (NASDAQ:MLND) is the least popular one with only 9 bullish hedge fund positions. Overseas Shipholding Group, Inc. (NYSE:OSG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately OSG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); OSG investors were disappointed as the stock returned -27.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.