Is ORBCOMM Inc (NASDAQ:ORBC) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

Hedge fund interest in ORBCOMM Inc (NASDAQ:ORBC) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare ORBC to other stocks including CBRE Clarion Global Real Estate Income Fund (NYSE:IGR), Monotype Imaging Holdings Inc. (NASDAQ:TYPE), and Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the key hedge fund action regarding ORBCOMM Inc (NASDAQ:ORBC).

Hedge fund activity in ORBCOMM Inc (NASDAQ:ORBC)

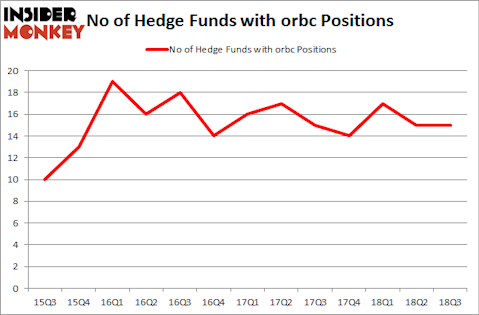

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from one quarter earlier. On the other hand, there were a total of 14 hedge funds with a bullish position in ORBC at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Adage Capital Management was the largest shareholder of ORBCOMM Inc (NASDAQ:ORBC), with a stake worth $72.2 million reported as of the end of September. Trailing Adage Capital Management was Ariel Investments, which amassed a stake valued at $20.3 million. Impax Asset Management, Royce & Associates, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because ORBCOMM Inc (NASDAQ:ORBC) has witnessed a decline in interest from the smart money, it’s easy to see that there lies a certain “tier” of money managers that slashed their entire stakes by the end of the third quarter. It’s worth mentioning that Josh Goldberg’s G2 Investment Partners Management cut the biggest investment of all the hedgies followed by Insider Monkey, comprising close to $2 million in stock. Gavin Saitowitz and Cisco J. del Valle’s fund, Springbok Capital, also sold off its stock, about $0 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to ORBCOMM Inc (NASDAQ:ORBC). We will take a look at CBRE Clarion Global Real Estate Income Fund (NYSE:IGR), Monotype Imaging Holdings Inc. (NASDAQ:TYPE), Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI), and Heska Corp (NASDAQ:HSKA). All of these stocks’ market caps resemble ORBC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IGR | 2 | 444 | -1 |

| TYPE | 18 | 203680 | 2 |

| CHI | 1 | 124 | 0 |

| HSKA | 10 | 69102 | 1 |

| Average | 7.75 | 68338 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $130 million in ORBC’s case. Monotype Imaging Holdings Inc. (NASDAQ:TYPE) is the most popular stock in this table. On the other hand Calamos Convertible Opportunities and Income Fund (NASDAQ:CHI) is the least popular one with only 1 bullish hedge fund positions. ORBCOMM Inc (NASDAQ:ORBC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TYPE might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.