Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards ONEOK, Inc. (NYSE:OKE) to find out whether it was one of their high conviction long-term ideas.

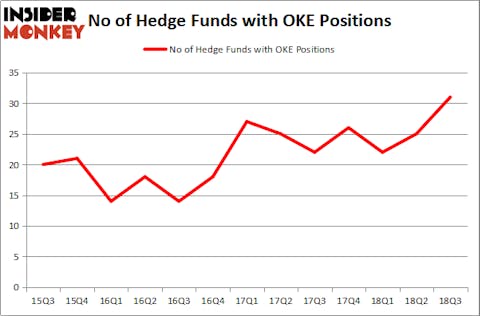

Is ONEOK, Inc. (NYSE:OKE) a good investment right now? Money managers are becoming more confident. The number of long hedge fund positions improved by 6 recently. Our calculations also showed that OKE isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals market participants use to assess publicly traded companies. A duo of the most under-the-radar signals are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best investment managers can trounce the S&P 500 by a superb margin (see the details here).

Let’s analyze the recent hedge fund action regarding ONEOK, Inc. (NYSE:OKE).

What does the smart money think about ONEOK, Inc. (NYSE:OKE)?

At Q3’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 24% from the second quarter of 2018. By comparison, 26 hedge funds held shares or bullish call options in OKE heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Millennium Management, managed by Israel Englander, holds the number one position in ONEOK, Inc. (NYSE:OKE). Millennium Management has a $150.4 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, led by Jim Simons, holding a $108.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers that hold long positions consist of Stuart J. Zimmer’s Zimmer Partners, D. E. Shaw’s D E Shaw and Vince Maddi and Shawn Brennan’s SIR Capital Management.

As one would reasonably expect, key hedge funds were breaking ground themselves. Point72 Asset Management, managed by Steve Cohen, initiated the most valuable position in ONEOK, Inc. (NYSE:OKE). Point72 Asset Management had $10 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $8.6 million position during the quarter. The other funds with brand new OKE positions are Ian Cumming and Joseph Steinberg’s Leucadia National, Bruce Kovner’s Caxton Associates LP, and Jeffrey Talpins’s Element Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as ONEOK, Inc. (NYSE:OKE) but similarly valued. We will take a look at Chunghwa Telecom Co., Ltd (NYSE:CHT), MPLX LP (NYSE:MPLX), ICICI Bank Limited (NYSE:IBN), and Royal Caribbean Cruises Ltd. (NYSE:RCL). This group of stocks’ market caps resemble OKE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHT | 4 | 116137 | -1 |

| MPLX | 11 | 355115 | -1 |

| IBN | 22 | 426495 | 0 |

| RCL | 42 | 2207182 | 4 |

| Average | 19.75 | 776232 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $776 million. That figure was $518 million in OKE’s case. Royal Caribbean Cruises Ltd. (NYSE:RCL) is the most popular stock in this table. On the other hand Chunghwa Telecom Co., Ltd (NYSE:CHT) is the least popular one with only 4 bullish hedge fund positions. ONEOK, Inc. (NYSE:OKE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RCL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.