It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards ONEOK, Inc. (NYSE:OKE) changed during the first quarter.

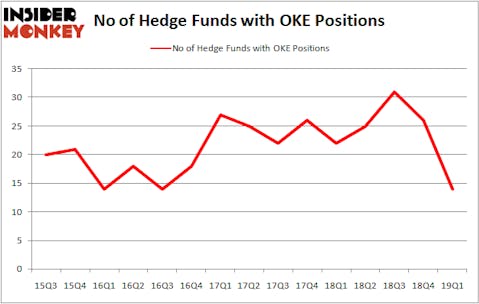

Is ONEOK, Inc. (NYSE:OKE) a splendid stock to buy now? Investors who are in the know are in a bearish mood. The number of long hedge fund bets went down by 12 recently. Our calculations also showed that OKE isn’t among the 30 most popular stocks among hedge funds. OKE was in 14 hedge funds’ portfolios at the end of the first quarter of 2019. There were 26 hedge funds in our database with OKE positions at the end of the previous quarter.

At the moment there are dozens of signals shareholders can use to value their stock investments. Some of the most underrated signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can beat their index-focused peers by a significant amount (see the details here).

James Dondero of Highland Capital Management

Let’s review the recent hedge fund action regarding ONEOK, Inc. (NYSE:OKE).

Hedge fund activity in ONEOK, Inc. (NYSE:OKE)

At the end of the first quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -46% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards OKE over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of ONEOK, Inc. (NYSE:OKE), with a stake worth $205.7 million reported as of the end of March. Trailing Zimmer Partners was Deep Basin Capital, which amassed a stake valued at $23.2 million. GAMCO Investors, Citadel Investment Group, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as ONEOK, Inc. (NYSE:OKE) has experienced bearish sentiment from the aggregate hedge fund industry, we can see that there is a sect of hedgies that decided to sell off their positions entirely heading into Q3. Intriguingly, Jim Simons’s Renaissance Technologies cut the biggest position of all the hedgies followed by Insider Monkey, worth an estimated $89.7 million in stock. Ken Griffin’s fund, Citadel Investment Group, also cut its stock, about $19.6 million worth. These moves are interesting, as total hedge fund interest fell by 12 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to ONEOK, Inc. (NYSE:OKE). These stocks are Baker Hughes, a GE company (NYSE:BHGE), Southwest Airlines Co. (NYSE:LUV), Pinduoduo Inc. (NASDAQ:PDD), and IQVIA Holdings, Inc. (NYSE:IQV). This group of stocks’ market caps are closest to OKE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BHGE | 23 | 415986 | -5 |

| LUV | 35 | 3383550 | -5 |

| PDD | 32 | 496446 | 12 |

| IQV | 64 | 5288724 | 15 |

| Average | 38.5 | 2396177 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.5 hedge funds with bullish positions and the average amount invested in these stocks was $2396 million. That figure was $279 million in OKE’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Baker Hughes, a GE company (NYSE:BHGE) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks ONEOK, Inc. (NYSE:OKE) is even less popular than BHGE. Hedge funds dodged a bullet by taking a bearish stance towards OKE. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately OKE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); OKE investors were disappointed as the stock returned -3.9% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.