During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of OMNOVA Solutions Inc. (NYSE:OMN) and see how the stock is affected by the recent hedge fund activity.

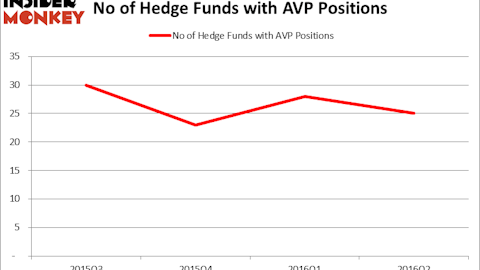

Is OMNOVA Solutions Inc. (NYSE:OMN) the right investment to pursue these days? Investors who are in the know are taking a pessimistic view. The number of long hedge fund positions decreased by 1 recently. Our calculations also showed that OMN isn’t among the 30 most popular stocks among hedge funds. OMN was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with OMN positions at the end of the previous quarter.

To the average investor there are tons of signals investors can use to value stocks. A duo of the less utilized signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite fund managers can outclass their index-focused peers by a significant amount (see the details here).

Let’s take a peek at the key hedge fund action regarding OMNOVA Solutions Inc. (NYSE:OMN).

What does the smart money think about OMNOVA Solutions Inc. (NYSE:OMN)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OMN over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in OMNOVA Solutions Inc. (NYSE:OMN), which was worth $17.1 million at the end of the third quarter. On the second spot was Scopus Asset Management which amassed $11.3 million worth of shares. Moreover, GAMCO Investors, Barington Capital Group, and GLG Partners were also bullish on OMNOVA Solutions Inc. (NYSE:OMN), allocating a large percentage of their portfolios to this stock.

Since OMNOVA Solutions Inc. (NYSE:OMN) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few money managers who sold off their full holdings by the end of the third quarter. At the top of the heap, Dmitry Balyasny’s Balyasny Asset Management cut the biggest stake of the 700 funds watched by Insider Monkey, totaling an estimated $0.3 million in stock, and Ernest Chow and Jonathan Howe’s Sensato Capital Management was right behind this move, as the fund dumped about $0.2 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to OMNOVA Solutions Inc. (NYSE:OMN). These stocks are BlackRock MuniYield California Quality Fund, Inc. (NYSE:MCA), U.S. Lime & Minerals Inc. (NASDAQ:USLM), Dorian LPG Ltd (NYSE:LPG), and Sierra Bancorp (NASDAQ:BSRR). This group of stocks’ market caps are similar to OMN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCA | 3 | 1852 | 0 |

| USLM | 4 | 20060 | -2 |

| LPG | 6 | 87254 | 0 |

| BSRR | 7 | 18338 | 0 |

| Average | 5 | 32 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $64 million in OMN’s case. Sierra Bancorp (NASDAQ:BSRR) is the most popular stock in this table. On the other hand BlackRock MuniYield California Quality Fund, Inc. (NYSE:MCA) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks OMNOVA Solutions Inc. (NYSE:OMN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.