Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Is Omnicom Group Inc. (NYSE:OMC) the right pick for your portfolio? Investors who are in the know are buying. The number of bullish hedge fund bets inched up by 6 recently, and there were 19 bullish investors in our database at the end of the third quarter. Still, the number of hedge funds with long positions in the company was far from enough for it to count as on of the 30 most popular stocks among hedge funds in Q3 of 2018. Nevertheless, we still think that the company requires more detailed analyses, which is why at the end of this article we will compare it with other companies of similar market caps.

In the 21st century investor’s toolkit there are several indicators market participants can use to evaluate their stock investments. A couple of the most useful indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can outperform the market by a superb amount (see the details here).

While researching to gather more data about Omnicom Group Inc. (NYSE:OMC), we tracked down First Eagle Global Value Team’s Q3 Commentary, in which the stock is mentioned:

“Omnicom Group, a US-based global advertising company, fell as weaker-than-expected US ad growth in the second quarter heightened concerns that the industry is being structurally challenged by the growth of social media, the rise of independent digital agencies and competition from consultants. While Omnicom’s business is certainly challenged by all of these factors, we believe that over the long term, it will remain a key advisor to multinational clients needing help in managing their multi-billion-dollar ad budgets across all advertising media.”

Let’s review the key hedge fund action surrounding Omnicom Group Inc. (NYSE:OMC).

Hedge fund activity in Omnicom Group Inc. (NYSE:OMC)

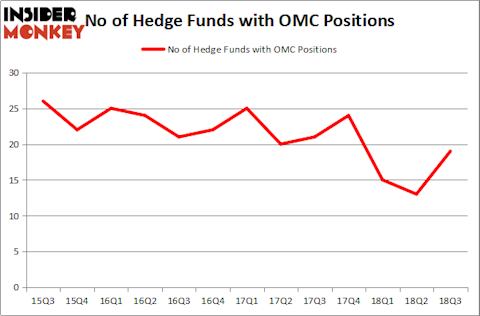

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 46% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in OMC over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Richard S. Pzena’s Pzena Investment Management has the largest position in Omnicom Group Inc. (NYSE:OMC), worth close to $498.6 million, comprising 2.4% of its total 13F portfolio. Coming in second is John W. Rogers of Ariel Investments, with a $76.1 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of John Overdeck and David Siegel’s Two Sigma Advisors, Charles de Vaulx’s International Value Advisers and Steve Cohen’s Point72 Asset Management.

Consequently, key hedge funds have jumped into Omnicom Group Inc. (NYSE:OMC) headfirst. Point72 Asset Management, managed by Steve Cohen, created the most outsized call position in Omnicom Group Inc. (NYSE:OMC). Point72 Asset Management had $6.8 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $0.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, D. E. Shaw’s D E Shaw, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Omnicom Group Inc. (NYSE:OMC) but similarly valued. We will take a look at Ball Corporation (NYSE:BLL), Citrix Systems, Inc. (NASDAQ:CTXS), Noble Energy, Inc. (NYSE:NBL), and MGM Resorts International (NYSE:MGM). This group of stocks’ market valuations resemble OMC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BLL | 20 | 466727 | 0 |

| CTXS | 37 | 2448498 | 5 |

| NBL | 26 | 994521 | -6 |

| MGM | 49 | 2007648 | -2 |

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $1.48 billion. That figure was $725 million in OMC’s case. MGM Resorts International (NYSE:MGM) is the most popular stock in this table. On the other hand Ball Corporation (NYSE:BLL) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Omnicom Group Inc. (NYSE:OMC) is even less popular than BLL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.