Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

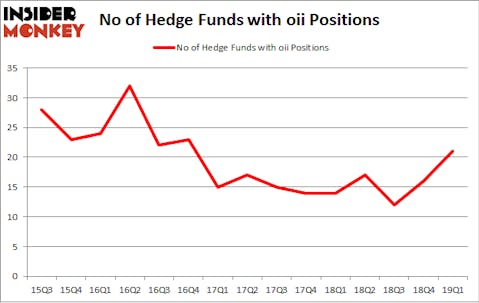

Is Oceaneering International, Inc. (NYSE:OII) undervalued? Hedge funds are buying. The number of long hedge fund positions moved up by 5 lately. Our calculations also showed that oii isn’t among the 30 most popular stocks among hedge funds. OII was in 21 hedge funds’ portfolios at the end of the first quarter of 2019. There were 16 hedge funds in our database with OII positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action surrounding Oceaneering International, Inc. (NYSE:OII).

How are hedge funds trading Oceaneering International, Inc. (NYSE:OII)?

At Q1’s end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 31% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards OII over the last 15 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

More specifically, Fisher Asset Management was the largest shareholder of Oceaneering International, Inc. (NYSE:OII), with a stake worth $37.4 million reported as of the end of March. Trailing Fisher Asset Management was AQR Capital Management, which amassed a stake valued at $15 million. D E Shaw, Arrowstreet Capital, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the most outsized position in Oceaneering International, Inc. (NYSE:OII). Arrowstreet Capital had $11.7 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $6.3 million position during the quarter. The other funds with brand new OII positions are Noam Gottesman’s GLG Partners, Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, and David Costen Haley’s HBK Investments.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Oceaneering International, Inc. (NYSE:OII) but similarly valued. We will take a look at Ferro Corporation (NYSE:FOE), Prestige Consumer Healthcare Inc. (NYSE:PBH), Matson, Inc. (NYSE:MATX), and FBL Financial Group, Inc. (NYSE:FFG). This group of stocks’ market caps resemble OII’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOE | 16 | 216138 | -3 |

| PBH | 13 | 66863 | -2 |

| MATX | 9 | 6472 | -3 |

| FFG | 7 | 7522 | 1 |

| Average | 11.25 | 74249 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $128 million in OII’s case. Ferro Corporation (NYSE:FOE) is the most popular stock in this table. On the other hand FBL Financial Group, Inc. (NYSE:FFG) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Oceaneering International, Inc. (NYSE:OII) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on OII as the stock returned 5.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.