Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 817 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Nevro Corp (NYSE:NVRO).

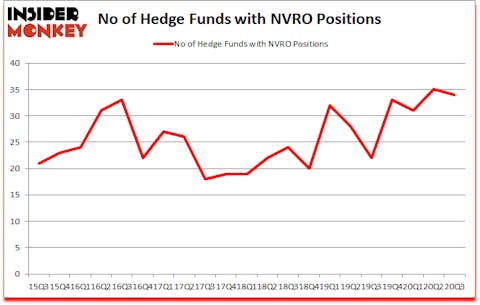

Is NVRO a good stock to buy? Nevro Corp (NYSE:NVRO) has experienced a decrease in hedge fund interest lately. Nevro Corp (NYSE:NVRO) was in 34 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 35. Our calculations also showed that NVRO isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a multitude of formulas shareholders employ to analyze their stock investments. Two of the most innovative formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite hedge fund managers can trounce their index-focused peers by a solid amount (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a glance at the new hedge fund action surrounding Nevro Corp (NYSE:NVRO).

Do Hedge Funds Think NVRO Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NVRO over the last 21 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, D. E. Shaw’s D E Shaw has the number one position in Nevro Corp (NYSE:NVRO), worth close to $175.1 million, corresponding to 0.2% of its total 13F portfolio. Sitting at the No. 2 spot is Perceptive Advisors, managed by Joseph Edelman, which holds a $115.1 million position; 1.7% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism comprise Arthur B Cohen and Joseph Healey’s Healthcor Management LP, Jeremy Green’s Redmile Group and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management. In terms of the portfolio weights assigned to each position Iron Triangle Partners allocated the biggest weight to Nevro Corp (NYSE:NVRO), around 4.98% of its 13F portfolio. Tiger Eye Capital is also relatively very bullish on the stock, designating 4.93 percent of its 13F equity portfolio to NVRO.

Judging by the fact that Nevro Corp (NYSE:NVRO) has experienced falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of hedge funds that slashed their entire stakes by the end of the third quarter. Interestingly, Anand Parekh’s Alyeska Investment Group dropped the largest stake of all the hedgies monitored by Insider Monkey, valued at close to $14.2 million in stock, and Phill Gross and Robert Atchinson’s Adage Capital Management was right behind this move, as the fund cut about $5.4 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Nevro Corp (NYSE:NVRO). We will take a look at Skechers USA Inc (NYSE:SKX), Euronet Worldwide, Inc. (NASDAQ:EEFT), Choice Hotels International, Inc. (NYSE:CHH), Enel Chile S.A. (NYSE:ENIC), Diamondback Energy Inc (NASDAQ:FANG), KT Corporation (NYSE:KT), and Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH). This group of stocks’ market valuations are similar to NVRO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SKX | 28 | 480907 | -5 |

| EEFT | 39 | 395554 | 2 |

| CHH | 27 | 124786 | 5 |

| ENIC | 4 | 14899 | -1 |

| FANG | 23 | 133783 | -6 |

| KT | 10 | 147562 | -2 |

| NCLH | 26 | 241506 | -2 |

| Average | 22.4 | 219857 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.4 hedge funds with bullish positions and the average amount invested in these stocks was $220 million. That figure was $815 million in NVRO’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand Enel Chile S.A. (NYSE:ENIC) is the least popular one with only 4 bullish hedge fund positions. Nevro Corp (NYSE:NVRO) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for NVRO is 76. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and still beat the market by 16.4 percentage points. Hedge funds were also right about betting on NVRO as the stock returned 30.1% since the end of Q3 (through 12/18) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Nevro Corp (NYSE:NVRO)

Follow Nevro Corp (NYSE:NVRO)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.