Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Restaurant Brands International Inc (NYSE:QSR)? The smart money sentiment can provide an answer to this question.

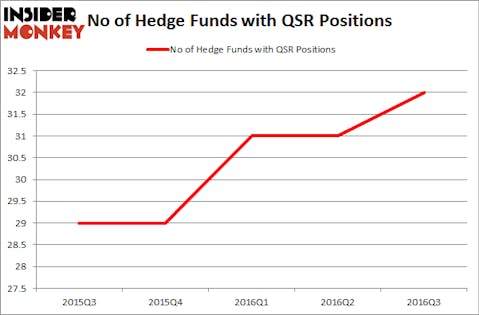

Is Restaurant Brands International Inc (NYSE:QSR) a buy right now? Money managers are in a bullish mood. The number of long hedge fund positions moved up by 1 in recent months. At the end of this article we will also compare QSR to other stocks including LKQ Corporation (NASDAQ:LKQ), Discovery Communications Inc. (NASDAQ:DISCK), and Celanese Corporation (NYSE:CE) to get a better sense of its popularity.

Follow Restaurant Brands International Inc. (NYSE:QSR)

Follow Restaurant Brands International Inc. (NYSE:QSR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SpeedKingz/Shutterstock.com

Keeping this in mind, we’re going to take a glance at the latest action encompassing Restaurant Brands International Inc (NYSE:QSR).

What does the smart money think about Restaurant Brands International Inc (NYSE:QSR)?

At the end of the third quarter, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 3% from the previous quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Bill Ackman’s Pershing Square has the number one position in Restaurant Brands International Inc (NYSE:QSR), worth close to $1.74 billion, amounting to 32.2% of its total 13F portfolio. Sitting at the No. 2 spot is Berkshire Hathaway, managed by Warren Buffett, which holds a $376.2 million position. Remaining hedge funds and institutional investors with similar optimism consist of Aaron Cowen’s Suvretta Capital Management, David Gallo’s Valinor Management LLC and Chase Coleman’s Tiger Global Management LLC.

As industry-wide interest jumped, key money managers were leading the bulls’ herd. Newbrook Capital Advisors, managed by Robert Boucai, created the largest position in Restaurant Brands International Inc (NYSE:QSR). Newbrook Capital Advisors had $14.6 million invested in the company at the end of the quarter. Bruce Kovner’s Caxton Associates LP also initiated a $2.2 million position during the quarter. The following funds were also among the new QSR investors: Peter Muller’s PDT Partners, Joel Greenblatt’s Gotham Asset Management, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Restaurant Brands International Inc (NYSE:QSR) but similarly valued. These stocks are LKQ Corporation (NASDAQ:LKQ), Discovery Communications Inc. (NASDAQ:DISCK), Celanese Corporation (NYSE:CE), and Hologic, Inc. (NASDAQ:HOLX). This group of stocks’ market caps are closest to QSR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LKQ | 32 | 668630 | 2 |

| DISCK | 21 | 280090 | -3 |

| CE | 31 | 817436 | -2 |

| HOLX | 33 | 812836 | -2 |

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $645 million. That figure was $3.14 billion in QSR’s case. Hologic, Inc. (NASDAQ:HOLX) is the most popular stock in this table. On the other hand Discovery Communications Inc. (NASDAQ:DISCK) is the least popular one with only 21 bullish hedge fund positions. Restaurant Brands International Inc (NYSE:QSR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal, as are the facts that hedge fund ownership of the stock hasn’t dropped in any quarter over the past year, and that it’s held by two hedge fund titans in the forms of Bill Ackman and Warren Buffett.

Disclosure: None