The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. In this article we look at what those investors think of NortonLifeLock Inc. (NASDAQ:NLOK).

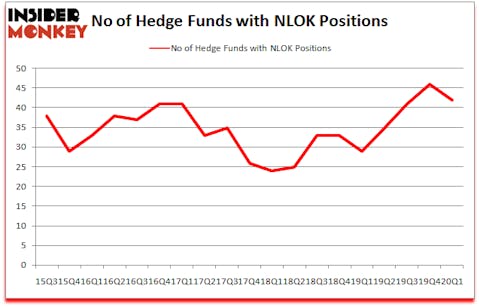

Is NortonLifeLock Inc. (NASDAQ:NLOK) going to take off soon? Investors who are in the know are in a pessimistic mood. The number of bullish hedge fund positions decreased by 4 in recent months. Our calculations also showed that NLOK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). NLOK was in 42 hedge funds’ portfolios at the end of the first quarter of 2020. There were 46 hedge funds in our database with NLOK positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72% since March 2017 and outperformed the S&P 500 ETFs by more than 44 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Jeffrey Smith of Starboard Value LP

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this successful trader’s “corona catalyst plays“. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a peek at the new hedge fund action encompassing NortonLifeLock Inc. (NASDAQ:NLOK).

What have hedge funds been doing with NortonLifeLock Inc. (NASDAQ:NLOK)?

At the end of the first quarter, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. On the other hand, there were a total of 29 hedge funds with a bullish position in NLOK a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in NortonLifeLock Inc. (NASDAQ:NLOK) was held by Starboard Value LP, which reported holding $499 million worth of stock at the end of September. It was followed by AQR Capital Management with a $244.9 million position. Other investors bullish on the company included Citadel Investment Group, Weiss Asset Management, and Soros Fund Management. In terms of the portfolio weights assigned to each position Starboard Value LP allocated the biggest weight to NortonLifeLock Inc. (NASDAQ:NLOK), around 20.23% of its 13F portfolio. Totem Point Management is also relatively very bullish on the stock, dishing out 18.71 percent of its 13F equity portfolio to NLOK.

Due to the fact that NortonLifeLock Inc. (NASDAQ:NLOK) has experienced declining sentiment from hedge fund managers, it’s easy to see that there were a few fund managers who sold off their full holdings in the third quarter. Interestingly, Paul Singer’s Elliott Management cut the largest stake of the 750 funds watched by Insider Monkey, totaling an estimated $68 million in stock. Cyrus de Weck’s fund, Portsea Asset Management, also dropped its stock, about $30.1 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 4 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as NortonLifeLock Inc. (NASDAQ:NLOK) but similarly valued. We will take a look at Expeditors International of Washington, Inc. (NASDAQ:EXPD), SS&C Technologies Holdings, Inc. (NASDAQ:SSNC), Shinhan Financial Group Co., Ltd. (NYSE:SHG), and Discover Financial Services (NYSE:DFS). This group of stocks’ market caps resemble NLOK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXPD | 31 | 346287 | 4 |

| SSNC | 57 | 1732077 | -2 |

| SHG | 5 | 8469 | 2 |

| DFS | 40 | 466951 | 1 |

| Average | 33.25 | 638446 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $638 million. That figure was $1352 million in NLOK’s case. SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) is the most popular stock in this table. On the other hand Shinhan Financial Group Co., Ltd. (NYSE:SHG) is the least popular one with only 5 bullish hedge fund positions. NortonLifeLock Inc. (NASDAQ:NLOK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on NLOK as the stock returned 21.8% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Gen Digital Inc. (NASDAQ:GEN)

Follow Gen Digital Inc. (NASDAQ:GEN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.