Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about NMI Holdings Inc (NASDAQ:NMIH).

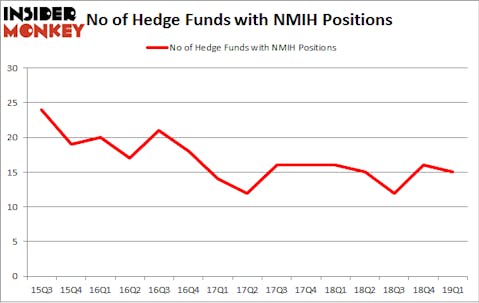

NMI Holdings Inc (NASDAQ:NMIH) investors should pay attention to a decrease in activity from the world’s largest hedge funds in recent months. NMIH was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. There were 16 hedge funds in our database with NMIH positions at the end of the previous quarter. Our calculations also showed that nmih isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

We’re going to go over the fresh hedge fund action regarding NMI Holdings Inc (NASDAQ:NMIH).

What does smart money think about NMI Holdings Inc (NASDAQ:NMIH)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -6% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in NMIH a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in NMI Holdings Inc (NASDAQ:NMIH) was held by Oaktree Capital Management, which reported holding $147 million worth of stock at the end of March. It was followed by Renaissance Technologies with a $51.7 million position. Other investors bullish on the company included Driehaus Capital, One Tusk Investment Partners, and PEAK6 Capital Management.

Since NMI Holdings Inc (NASDAQ:NMIH) has faced bearish sentiment from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of funds that slashed their full holdings in the third quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the biggest investment of the “upper crust” of funds watched by Insider Monkey, valued at about $2.4 million in stock. Minhua Zhang’s fund, Weld Capital Management, also sold off its stock, about $1.3 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 1 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as NMI Holdings Inc (NASDAQ:NMIH) but similarly valued. We will take a look at Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), Liberty Oilfield Services Inc. (NYSE:LBRT), Eagle Bancorp, Inc. (NASDAQ:EGBN), and PennyMac Financial Services Inc (NYSE:PFSI). This group of stocks’ market values match NMIH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARWR | 16 | 172031 | 3 |

| LBRT | 14 | 77200 | 2 |

| EGBN | 11 | 45405 | -1 |

| PFSI | 16 | 113181 | 6 |

| Average | 14.25 | 101954 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $102 million. That figure was $229 million in NMIH’s case. Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) is the most popular stock in this table. On the other hand Eagle Bancorp, Inc. (NASDAQ:EGBN) is the least popular one with only 11 bullish hedge fund positions. NMI Holdings Inc (NASDAQ:NMIH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on NMIH as the stock returned 18.3% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.