At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

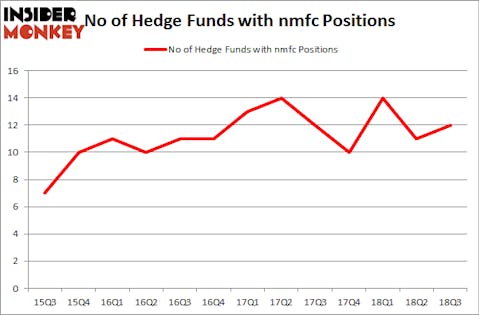

New Mountain Finance Corp. (NYSE:NMFC) was in 12 hedge funds’ portfolios at the end of September. NMFC investors should pay attention to an increase in hedge fund interest lately. There were 11 hedge funds in our database with NMFC positions at the end of the previous quarter. Our calculations also showed that nmfc isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are assumed to be worthless, old investment tools of yesteryear. While there are over 8,000 funds trading today, We choose to focus on the upper echelon of this group, about 700 funds. These hedge fund managers have their hands on the majority of the smart money’s total capital, and by tailing their top stock picks, Insider Monkey has formulated several investment strategies that have historically beaten the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the key hedge fund action encompassing New Mountain Finance Corp. (NYSE:NMFC).

What does the smart money think about New Mountain Finance Corp. (NYSE:NMFC)?

Heading into the fourth quarter of 2018, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the second quarter of 2018. On the other hand, there were a total of 10 hedge funds with a bullish position in NMFC at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, holds the number one position in New Mountain Finance Corp. (NYSE:NMFC). Polar Capital has a $4.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $4.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish consist of Robert B. Gillam’s McKinley Capital Management, Israel Englander’s Millennium Management and Israel Englander’s Millennium Management.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most outsized position in New Mountain Finance Corp. (NYSE:NMFC). Arrowstreet Capital had $4.1 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP and Peter Muller’s PDT Partners.

Let’s check out hedge fund activity in other stocks similar to New Mountain Finance Corp. (NYSE:NMFC). We will take a look at Owens & Minor, Inc. (NYSE:OMI), The St. Joe Company (NYSE:JOE), SunPower Corporation (NASDAQ:SPWR), and Vista Outdoor Inc (NYSE:VSTO). This group of stocks’ market values match NMFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OMI | 11 | 41574 | -2 |

| JOE | 15 | 512263 | 1 |

| SPWR | 10 | 39683 | 3 |

| VSTO | 19 | 127450 | 5 |

| Average | 13.75 | 180243 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $180 million. That figure was $20 million in NMFC’s case. Vista Outdoor Inc (NYSE:VSTO) is the most popular stock in this table. On the other hand SunPower Corporation (NASDAQ:SPWR) is the least popular one with only 10 bullish hedge fund positions. New Mountain Finance Corp. (NYSE:NMFC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard VSTO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.