The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider New Gold Inc. (NYSEAMEX:NGD) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

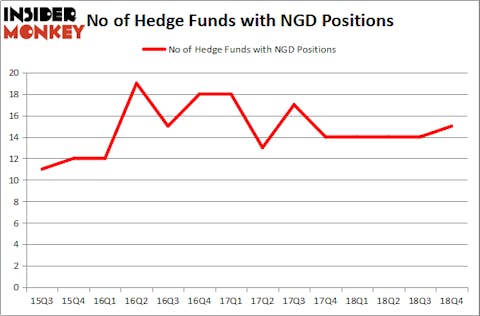

New Gold Inc. (NYSEAMEX:NGD) was in 15 hedge funds’ portfolios at the end of the fourth quarter of 2018. NGD investors should be aware of an increase in hedge fund interest lately. There were 14 hedge funds in our database with NGD holdings at the end of the previous quarter. Our calculations also showed that NGD isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of signals market participants have at their disposal to size up stocks. A pair of the most useful signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the best hedge fund managers can beat the S&P 500 by a solid amount (see the details here).

We’re going to take a look at the new hedge fund action encompassing New Gold Inc. (NYSEAMEX:NGD).

What have hedge funds been doing with New Gold Inc. (NYSEAMEX:NGD)?

Heading into the first quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NGD over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in New Gold Inc. (NYSEAMEX:NGD) was held by Kopernik Global Investors, which reported holding $27.8 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $5.7 million position. Other investors bullish on the company included Saba Capital, Sprott Asset Management, and Arrowstreet Capital.

As aggregate interest increased, specific money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in New Gold Inc. (NYSEAMEX:NGD). Arrowstreet Capital had $2 million invested in the company at the end of the quarter. George Zweig, Shane Haas and Ravi Chander’s Signition LP also initiated a $0.1 million position during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as New Gold Inc. (NYSEAMEX:NGD) but similarly valued. These stocks are Overstock.com, Inc. (NASDAQ:OSTK), CURO Group Holdings Corp. (NYSE:CURO), TORM plc (NASDAQ:TRMD), and International Money Express, Inc. (NASDAQ:IMXI). All of these stocks’ market caps match NGD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OSTK | 10 | 20369 | -6 |

| CURO | 10 | 76163 | -6 |

| TRMD | 3 | 347978 | 1 |

| IMXI | 10 | 61880 | -1 |

| Average | 8.25 | 126598 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $127 million. That figure was $43 million in NGD’s case. Overstock.com, Inc. (NASDAQ:OSTK) is the most popular stock in this table. On the other hand TORM plc (NASDAQ:TRMD) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks New Gold Inc. (NYSEAMEX:NGD) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NGD wasn’t nearly as popular as these 15 stock and hedge funds that were betting on NGD were disappointed as the stock returned 11.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.