You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

In this article, we are going to take a look at Nautilus, Inc. (NYSE:NLS), which registered a decline in popularity among smart money investors in our database last quarter. In this way, 12 funds held shares of NLS at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Pinnacle Entertainment, Inc (NYSE:PNK), Solaredge Technologies Inc (NASDAQ:SEDG), and The Providence Service Corporation (NASDAQ:PRSC) to gather more data points.

Follow Bowflex Inc. (NYSE:BFX)

Follow Bowflex Inc. (NYSE:BFX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

rangizzz/Shutterstock.com

With all of this in mind, let’s take a peek at the latest action regarding Nautilus, Inc. (NYSE:NLS).

What does the smart money think about Nautilus, Inc. (NYSE:NLS)?

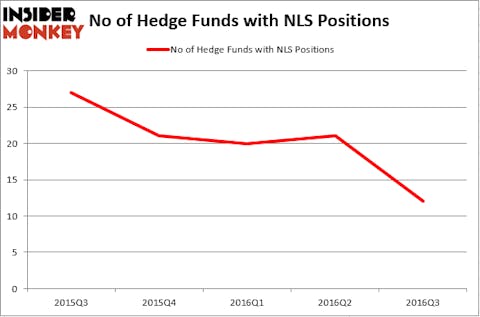

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, compared to 21 funds a quarter earlier. Below, you can check out the change in hedge fund sentiment towards NLS over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates has the number one position in Nautilus, Inc. (NYSE:NLS), worth close to $17.8 million, accounting for 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Headlands Capital, led by David Park, holding a $14.1 million position; the fund has 11.2% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish comprise Robert B. Gillam’s McKinley Capital Management, Renaissance Technologies, one of the largest hedge funds in the world, and Ken Fisher’s Fisher Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that dropped their entire stakes in the stock during the third quarter. It’s worth mentioning that Ken Grossman and Glen Schneider’s SG Capital Management dropped the biggest position of the 700 funds monitored by Insider Monkey, comprising close to $5.4 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dropped about $4.6 million worth of shares.

Let’s also examine hedge fund activity in other stocks similar to Nautilus, Inc. (NYSE:NLS). These stocks are Pinnacle Entertainment, Inc (NYSE:PNK), Solaredge Technologies Inc (NASDAQ:SEDG), The Providence Service Corporation (NASDAQ:PRSC), and A10 Networks Inc (NYSE:ATEN). This group of stocks’ market valuations resemble NLS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PNK | 21 | 235014 | 0 |

| SEDG | 12 | 135132 | 0 |

| PRSC | 10 | 159116 | -5 |

| ATEN | 16 | 61946 | 3 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $148 million. That figure was $51 million in NLS’s case. Pinnacle Entertainment, Inc (NYSE:PNK) is the most popular stock in this table. On the other hand The Providence Service Corporation (NASDAQ:PRSC) is the least popular one with only 10 bullish hedge fund positions. Nautilus, Inc. (NYSE:NLS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Pinnacle Entertainment might be a better candidate to consider taking a long position in.

Suggested Articles:

Easiest Avenged Sevenfold Songs To Play On Guitar

Best Job Opportunities For Economics Majors

Most Expensive Cigarette Brands

Disclosure: none