A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on National General Holdings Corp (NASDAQ:NGHC).

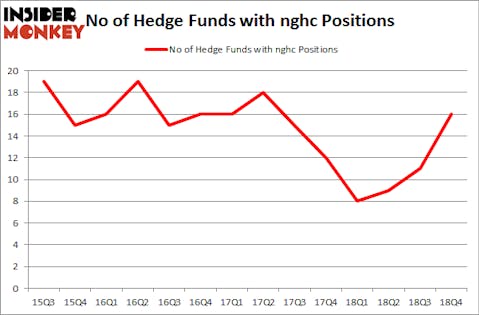

National General Holdings Corp (NASDAQ:NGHC) investors should be aware of an increase in support from the world’s most elite money managers lately. Our calculations also showed that nghc isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action surrounding National General Holdings Corp (NASDAQ:NGHC).

Hedge fund activity in National General Holdings Corp (NASDAQ:NGHC)

At Q4’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 45% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in NGHC a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in National General Holdings Corp (NASDAQ:NGHC) was held by Park West Asset Management, which reported holding $123.7 million worth of stock at the end of September. It was followed by MSDC Management with a $52.4 million position. Other investors bullish on the company included Nut Tree Capital, Maverick Capital, and Millennium Management.

Now, key hedge funds were leading the bulls’ herd. Nut Tree Capital, managed by Jared Nussbaum, established the most outsized position in National General Holdings Corp (NASDAQ:NGHC). Nut Tree Capital had $17.7 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $3.9 million investment in the stock during the quarter. The other funds with brand new NGHC positions are Minhua Zhang’s Weld Capital Management, Matthew Halbower’s Pentwater Capital Management, and Jim Simons’s Renaissance Technologies.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as National General Holdings Corp (NASDAQ:NGHC) but similarly valued. We will take a look at Kennametal Inc. (NYSE:KMT), NCR Corporation (NYSE:NCR), White Mountains Insurance Group Ltd (NYSE:WTM), and Fulton Financial Corp (NASDAQ:FULT). This group of stocks’ market caps match NGHC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KMT | 21 | 275426 | 0 |

| NCR | 20 | 163313 | 3 |

| WTM | 18 | 150863 | 2 |

| FULT | 12 | 12203 | 0 |

| Average | 17.75 | 150451 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $150 million. That figure was $219 million in NGHC’s case. Kennametal Inc. (NYSE:KMT) is the most popular stock in this table. On the other hand Fulton Financial Corp (NASDAQ:FULT) is the least popular one with only 12 bullish hedge fund positions. National General Holdings Corp (NASDAQ:NGHC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately NGHC wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); NGHC investors were disappointed as the stock returned -1.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.