Is Marvell Technology Group Ltd. (NASDAQ:MRVL) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

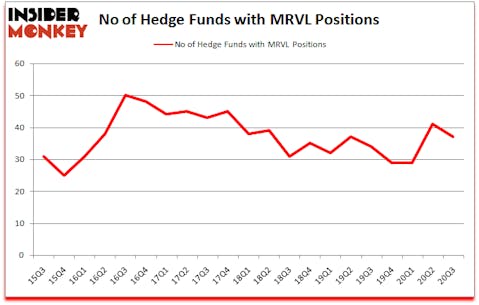

Is MRVL a good stock to buy? Marvell Technology Group Ltd. (NASDAQ:MRVL) was in 37 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 50. MRVL has experienced a decrease in enthusiasm from smart money in recent months. There were 41 hedge funds in our database with MRVL holdings at the end of June. Our calculations also showed that MRVL isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are dozens of methods investors use to assess publicly traded companies. A couple of the most innovative methods are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the elite money managers can outperform the market by a superb amount (see the details here).

Paul Tudor Jones of Tudor Investment Corp

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to take a peek at the fresh hedge fund action encompassing Marvell Technology Group Ltd. (NASDAQ:MRVL).

Do Hedge Funds Think MRVL Is A Good Stock To Buy Now?

At Q3’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in MRVL over the last 21 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Marvell Technology Group Ltd. (NASDAQ:MRVL) was held by Citadel Investment Group, which reported holding $121.6 million worth of stock at the end of September. It was followed by Holocene Advisors with a $115.4 million position. Other investors bullish on the company included Jericho Capital Asset Management, Millennium Management, and PEAK6 Capital Management. In terms of the portfolio weights assigned to each position Totem Point Management allocated the biggest weight to Marvell Technology Group Ltd. (NASDAQ:MRVL), around 7.56% of its 13F portfolio. Jericho Capital Asset Management is also relatively very bullish on the stock, designating 3.82 percent of its 13F equity portfolio to MRVL.

Since Marvell Technology Group Ltd. (NASDAQ:MRVL) has experienced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of fund managers who were dropping their full holdings by the end of the third quarter. It’s worth mentioning that Renaissance Technologies cut the biggest stake of the 750 funds watched by Insider Monkey, valued at close to $33 million in stock. John Hurley’s fund, Cavalry Asset Management, also cut its stock, about $25.7 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 4 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Marvell Technology Group Ltd. (NASDAQ:MRVL) but similarly valued. We will take a look at Franco-Nevada Corporation (NYSE:FNV), The Clorox Company (NYSE:CLX), Ford Motor Company (NYSE:F), Carrier Global Corporation (NYSE:CARR), Hormel Foods Corporation (NYSE:HRL), The Kroger Co. (NYSE:KR), and American Water Works Company, Inc. (NYSE:AWK). This group of stocks’ market caps are closest to MRVL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNV | 31 | 1518534 | 8 |

| CLX | 39 | 1898007 | 3 |

| F | 38 | 1079806 | 8 |

| CARR | 49 | 1880405 | 5 |

| HRL | 30 | 555456 | 3 |

| KR | 35 | 2470150 | -6 |

| AWK | 31 | 679131 | 1 |

| Average | 36.1 | 1440213 | 3.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.1 hedge funds with bullish positions and the average amount invested in these stocks was $1440 million. That figure was $479 million in MRVL’s case. Carrier Global Corporation (NYSE:CARR) is the most popular stock in this table. On the other hand Hormel Foods Corporation (NYSE:HRL) is the least popular one with only 30 bullish hedge fund positions. Marvell Technology Group Ltd. (NASDAQ:MRVL) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MRVL is 41.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 33.3% in 2020 through December 18th and still beat the market by 16.4 percentage points. Hedge funds were also right about betting on MRVL as the stock returned 19.8% since the end of Q3 (through 12/18) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Marvell Technology Group Ltd (NASDAQ:N/A)

Follow Marvell Technology Group Ltd (NASDAQ:N/A)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.