Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Milacron Holdings Corp (NYSE:MCRN)? The smart money sentiment can provide an answer to this question.

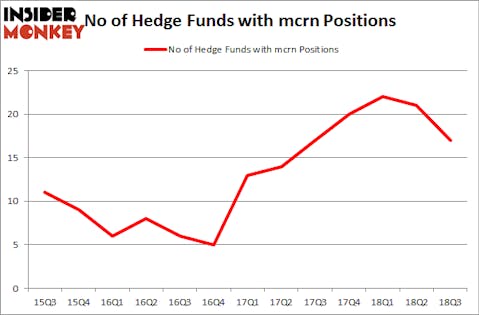

Is Milacron Holdings Corp (NYSE:MCRN) the right investment to pursue these days? The smart money is reducing their bets on the stock. The number of bullish hedge fund positions decreased by 4 recently. Our calculations also showed that mcrn isn’t among the 30 most popular stocks among hedge funds. MCRN was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. There were 21 hedge funds in our database with MCRN positions at the end of the previous quarter.

At the moment there are a multitude of gauges stock market investors have at their disposal to grade stocks. A couple of the most useful gauges are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top money managers can trounce their index-focused peers by a very impressive amount (see the details here).

Let’s take a look at the fresh hedge fund action encompassing Milacron Holdings Corp (NYSE:MCRN).

How are hedge funds trading Milacron Holdings Corp (NYSE:MCRN)?

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from the second quarter of 2018. By comparison, 20 hedge funds held shares or bullish call options in MCRN heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Royce & Associates held the most valuable stake in Milacron Holdings Corp (NYSE:MCRN), which was worth $20.2 million at the end of the third quarter. On the second spot was Hawk Ridge Management which amassed $9.5 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Sagard Capital Partners Management Corp were also bullish on Milacron Holdings Corp (NYSE:MCRN), allocating a large percentage of their portfolios to this stock.

Since Milacron Holdings Corp (NYSE:MCRN) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there were a few hedgies who were dropping their entire stakes in the third quarter. Interestingly, Richard S. Meisenberg’s ACK Asset Management said goodbye to the biggest investment of all the hedgies tracked by Insider Monkey, worth about $13 million in stock. Ira Unschuld’s fund, Brant Point Investment Management, also dropped its stock, about $5.2 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 4 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Milacron Holdings Corp (NYSE:MCRN) but similarly valued. These stocks are SPX Corporation (NYSE:SPXC), Warrior Met Coal, Inc. (NYSE:HCC), Adaptimmune Therapeutics plc (NASDAQ:ADAP), and C&J Energy Services, Inc (NYSE:CJ). All of these stocks’ market caps match MCRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPXC | 11 | 114731 | 1 |

| HCC | 35 | 495642 | 4 |

| ADAP | 13 | 375496 | -1 |

| CJ | 25 | 452046 | 0 |

| Average | 21 | 359479 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $359 million. That figure was $58 million in MCRN’s case. Warrior Met Coal, Inc. (NYSE:HCC) is the most popular stock in this table. On the other hand SPX Corporation (NYSE:SPXC) is the least popular one with only 11 bullish hedge fund positions. Milacron Holdings Corp (NYSE:MCRN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HCC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.