Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

In this article, we’ll take a closer look at Meredith Corporation (NYSE:MDP), which registered a decline in popularity among investors in our database between July and September. Overall, 14 funds held shares of Meredith Corporation at the end of the third quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Kennametal Inc. (NYSE:KMT), Kite Realty Group Trust (NYSE:KRG), and Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD) to gather more data points.

Follow Hawkeye Acquisition Inc. (NYSE:MDP)

Follow Hawkeye Acquisition Inc. (NYSE:MDP)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Shutter_M/Shutterstock.com

Keeping this in mind, we’re going to take a look at the fresh action encompassing Meredith Corporation (NYSE:MDP).

How have hedgies been trading Meredith Corporation (NYSE:MDP)?

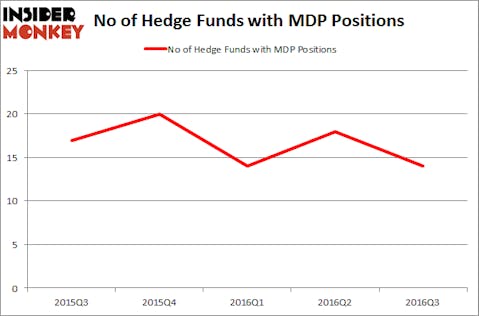

Heading into the fourth quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long MDP, down by four funds from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MDP over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John W. Rogers’ Ariel Investments has the largest position in Meredith Corporation (NYSE:MDP), worth close to $94.3 million, comprising 1.1% of its total 13F portfolio. Coming in second is Chuck Royce’s Royce & Associates, with a $84.8 million position; 0.6% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism comprise Ken Fisher’s Fisher Asset Management, Mario Gabelli’s GAMCO Investors, and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.