Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Medtronic plc. (NYSE:MDT) in this article.

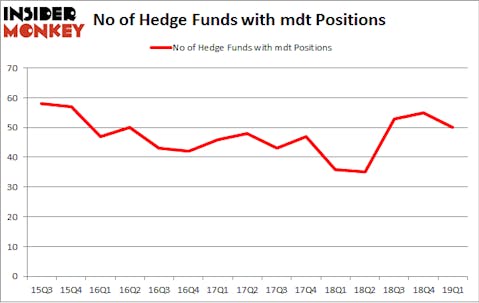

Medtronic plc. (NYSE:MDT) was in 50 hedge funds’ portfolios at the end of March. MDT has seen a decrease in enthusiasm from smart money in recent months. There were 55 hedge funds in our database with MDT holdings at the end of the previous quarter. Our calculations also showed that mdt isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Noam Gottesman, GLG Partners

Let’s take a look at the key hedge fund action regarding Medtronic plc. (NYSE:MDT).

What have hedge funds been doing with Medtronic plc. (NYSE:MDT)?

At Q1’s end, a total of 50 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the fourth quarter of 2018. On the other hand, there were a total of 36 hedge funds with a bullish position in MDT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, AQR Capital Management was the largest shareholder of Medtronic plc. (NYSE:MDT), with a stake worth $429.4 million reported as of the end of March. Trailing AQR Capital Management was D E Shaw, which amassed a stake valued at $401.3 million. Diamond Hill Capital, GLG Partners, and Healthcor Management LP were also very fond of the stock, giving the stock large weights in their portfolios.

Because Medtronic plc. (NYSE:MDT) has witnessed a decline in interest from hedge fund managers, logic holds that there is a sect of funds that decided to sell off their full holdings in the third quarter. At the top of the heap, Jeremy Green’s Redmile Group cut the biggest position of all the hedgies followed by Insider Monkey, comprising close to $38.2 million in stock, and Stephen J. Errico’s Locust Wood Capital Advisers was right behind this move, as the fund dumped about $36.9 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 5 funds in the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Medtronic plc. (NYSE:MDT) but similarly valued. These stocks are salesforce.com, inc. (NYSE:CRM), BHP Group (NYSE:BBL), Paypal Holdings Inc (NASDAQ:PYPL), and DowDuPont Inc. (NYSE:DWDP). All of these stocks’ market caps resemble MDT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRM | 93 | 5226445 | -6 |

| BBL | 21 | 948033 | 6 |

| PYPL | 93 | 3610295 | -10 |

| DWDP | 61 | 1910098 | -6 |

| Average | 67 | 2923718 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 67 hedge funds with bullish positions and the average amount invested in these stocks was $2924 million. That figure was $2124 million in MDT’s case. salesforce.com, inc. (NYSE:CRM) is the most popular stock in this table. On the other hand BHP Group (NYSE:BBL) is the least popular one with only 21 bullish hedge fund positions. Medtronic plc. (NYSE:MDT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on MDT, though not to the same extent, as the stock returned 1.6% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.