“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Hedge fund interest in Magnolia Oil & Gas Corporation (NASDAQ:MGY) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Patterson-UTI Energy, Inc. (NASDAQ:PTEN), Balchem Corporation (NASDAQ:BCPC), and Iridium Communications Inc. (NASDAQ:IRDM) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action encompassing Magnolia Oil & Gas Corporation (NASDAQ:MGY).

How are hedge funds trading Magnolia Oil & Gas Corporation (NASDAQ:MGY)?

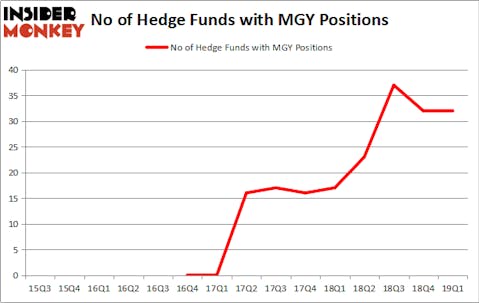

At the end of the first quarter, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MGY over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Todd J. Kantor’s Encompass Capital Advisors has the largest position in Magnolia Oil & Gas Corporation (NASDAQ:MGY), worth close to $55.8 million, amounting to 4.2% of its total 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $55.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions consist of Leon Cooperman’s Omega Advisors, Glenn Russell Dubin’s Highbridge Capital Management and Anand Parekh’s Alyeska Investment Group.

Judging by the fact that Magnolia Oil & Gas Corporation (NASDAQ:MGY) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of funds that elected to cut their full holdings in the third quarter. Interestingly, Nick Niell’s Arrowgrass Capital Partners dumped the largest investment of the “upper crust” of funds tracked by Insider Monkey, valued at close to $11.3 million in stock, and Amy Minella’s Cardinal Capital was right behind this move, as the fund said goodbye to about $10.7 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Magnolia Oil & Gas Corporation (NASDAQ:MGY). These stocks are Patterson-UTI Energy, Inc. (NASDAQ:PTEN), Balchem Corporation (NASDAQ:BCPC), Iridium Communications Inc. (NASDAQ:IRDM), and Neogen Corporation (NASDAQ:NEOG). All of these stocks’ market caps are similar to MGY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PTEN | 34 | 301384 | -5 |

| BCPC | 7 | 63045 | -4 |

| IRDM | 12 | 139662 | -1 |

| NEOG | 12 | 32821 | -2 |

| Average | 16.25 | 134228 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $134 million. That figure was $232 million in MGY’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand Balchem Corporation (NASDAQ:BCPC) is the least popular one with only 7 bullish hedge fund positions. Magnolia Oil & Gas Corporation (NASDAQ:MGY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately MGY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MGY were disappointed as the stock returned -5.9% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.