Artisan Partners, an investment management company, released its “Artisan Small Cap Fund” third quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, its Investor Class fund ARTSX returned 3.23%, Advisor Class fund APDSX posted a return of 3.27%, and Institutional Class fund APHSX returned 3.27%, compared to a return of 0.24% for the Russell 2000 Growth Index. In addition, please check the fund’s top five holdings to know its best picks in 2022.

In the third-quarter letter, Artisan Partners discussed stocks like MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI). Headquartered in Lowell, Massachusetts, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is a manufacturer of analog semiconductor solutions wireless and wireline application. On November 11, 2022, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) stock closed at $71.04 per share. One-month return of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) was 37.01% and its shares lost 6.06% of their value over the last 52 weeks. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) has a market capitalization of $4.973 billion.

Artisan Partners made the following comment about MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in its Q3 2022 investor letter:

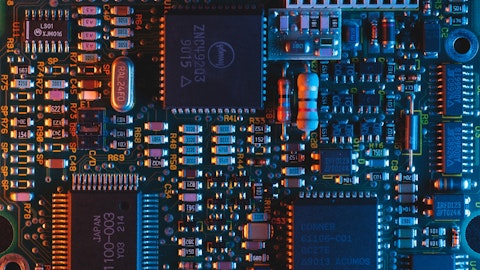

“MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) designs and manufactures high performance silicon and compound semiconductor analog/mixed signal chips used in the aerospace and defense, industrial, telecommunication and data center end markets. The company is led by a relatively new management team taking steps to accelerate topline growth and expand margins. The leadership team’s strategy is to addresses smaller, long-duration product cycle markets in which it can provide a differentiated offering, especially in compound semis such as GaAs, Al-GaAs, InP and GaN-on-SiC, using its design expertise and its US-trusted foundry / Department of Defense approved status. Rolling out several new, higher margin products and expanding into adjacent end markets such as auto and consumer should drive a compelling profit cycle in the periods ahead.”

electronics-6055226_1280

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 21 hedge fund portfolios held MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) at the end of the second quarter which was 21 in the previous quarter.

We discussed MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in another article and shared the best semiconductor stock picks of Goldman Sachs. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

Disclosure: None. This article is originally published at Insider Monkey.