Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Lydall, Inc. (NYSE:LDL) from the perspective of those elite funds.

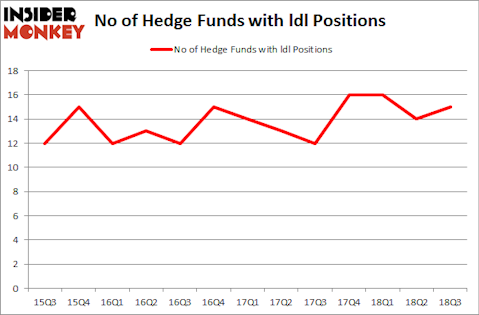

Is Lydall, Inc. (NYSE:LDL) a safe investment right now? Hedge funds are taking a bullish view. The number of long hedge fund bets rose by 1 recently. Our calculations also showed that ldl isn’t among the 30 most popular stocks among hedge funds. LDL was in 15 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with LDL positions at the end of the previous quarter.

In the eyes of most traders, hedge funds are seen as underperforming, outdated financial vehicles of years past. While there are over 8,000 funds trading at present, Our researchers look at the elite of this group, approximately 700 funds. These investment experts manage the majority of the hedge fund industry’s total capital, and by shadowing their unrivaled picks, Insider Monkey has discovered a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to analyze the key hedge fund action encompassing Lydall, Inc. (NYSE:LDL).

Hedge fund activity in Lydall, Inc. (NYSE:LDL)

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LDL over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Royce & Associates held the most valuable stake in Lydall, Inc. (NYSE:LDL), which was worth $14.1 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $9.8 million worth of shares. Moreover, D E Shaw, AlphaOne Capital Partners, and AQR Capital Management were also bullish on Lydall, Inc. (NYSE:LDL), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the largest position in Lydall, Inc. (NYSE:LDL). Marshall Wace LLP had $1.2 million invested in the company at the end of the quarter. Roger Ibbotson’s Zebra Capital Management also made a $0.4 million investment in the stock during the quarter. The only other fund with a new position in the stock is Frederick DiSanto’s Ancora Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Lydall, Inc. (NYSE:LDL) but similarly valued. We will take a look at IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP), Insys Therapeutics Inc (NASDAQ:INSY), Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (NYSE:VLRS), and Customers Bancorp Inc (NYSE:CUBI). All of these stocks’ market caps are similar to LDL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IRCP | 3 | 9927 | 1 |

| INSY | 5 | 35726 | 0 |

| VLRS | 5 | 64788 | -3 |

| CUBI | 9 | 18227 | 0 |

| Average | 5.5 | 32167 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $43 million in LDL’s case. Customers Bancorp Inc (NYSE:CUBI) is the most popular stock in this table. On the other hand IRSA Propiedades Comerciales S.A. (NASDAQ:IRCP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Lydall, Inc. (NYSE:LDL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.