Is LHC Group, Inc. (NASDAQ:LHCG) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

Is LHC Group, Inc. (NASDAQ:LHCG) a cheap investment now? The smart money is in an optimistic mood. The number of bullish hedge fund bets advanced by 1 recently. Our calculations also showed that LHCG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of methods market participants put to use to evaluate stocks. Some of the most under-the-radar methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the S&P 500 by a significant margin (see the details here).

We’re going to review the key hedge fund action encompassing LHC Group, Inc. (NASDAQ:LHCG).

How are hedge funds trading LHC Group, Inc. (NASDAQ:LHCG)?

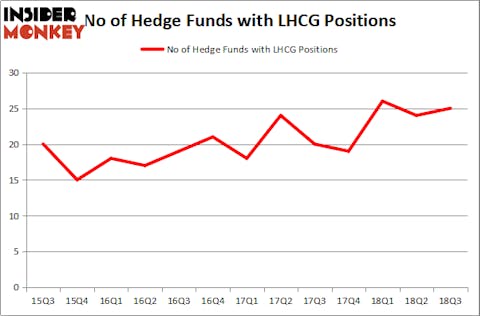

Heading into the fourth quarter of 2018, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LHCG over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in LHC Group, Inc. (NASDAQ:LHCG) was held by Polar Capital, which reported holding $27.8 million worth of stock at the end of September. It was followed by Redmile Group with a $22.4 million position. Other investors bullish on the company included Governors Lane, Arrowgrass Capital Partners, and Columbus Circle Investors.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Redmile Group, managed by Jeremy Green, established the largest position in LHC Group, Inc. (NASDAQ:LHCG). Redmile Group had $22.4 million invested in the company at the end of the quarter. Isaac Corre’s Governors Lane also initiated a $14.6 million position during the quarter. The following funds were also among the new LHCG investors: Isaac Corre’s Governors Lane, and Nick Niell’s Arrowgrass Capital Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as LHC Group, Inc. (NASDAQ:LHCG) but similarly valued. We will take a look at PDC Energy Inc (NASDAQ:PDCE), Sensient Technologies Corporation (NYSE:SXT), Rexnord Corp (NYSE:RXN), and Hilton Grand Vacations Inc. (NYSE:HGV). This group of stocks’ market valuations are closest to LHCG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PDCE | 19 | 181951 | 4 |

| SXT | 11 | 74341 | -3 |

| RXN | 15 | 169987 | -1 |

| HGV | 27 | 587168 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $253 million. That figure was $146 million in LHCG’s case. Hilton Grand Vacations Inc. (NYSE:HGV) is the most popular stock in this table. On the other hand Sensient Technologies Corporation (NYSE:SXT) is the least popular one with only 11 bullish hedge fund positions. LHC Group, Inc. (NASDAQ:LHCG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HGV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.