Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Knowles Corp (NYSE:KN).

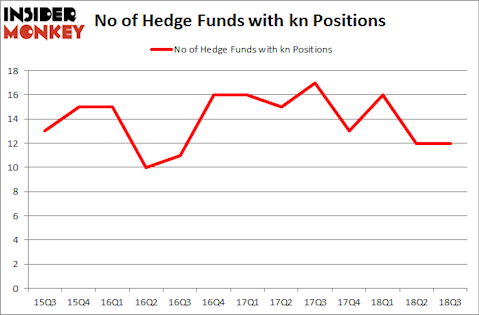

Hedge fund interest in Knowles Corp (NYSE:KN) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Kraton Corporation (NYSE:KRA), U.S. Physical Therapy, Inc. (NYSE:USPH), and WSFS Financial Corporation (NASDAQ:WSFS) to gather more data points.

Today there are many indicators market participants employ to value stocks. A pair of the best indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the elite investment managers can outclass the market by a healthy amount (see the details here).

We’re going to take a gander at the new hedge fund action regarding Knowles Corp (NYSE:KN).

How are hedge funds trading Knowles Corp (NYSE:KN)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the second quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in KN heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, D. E. Shaw’s D E Shaw has the largest position in Knowles Corp (NYSE:KN), worth close to $21.2 million, amounting to less than 0.1%% of its total 13F portfolio. The second largest stake is held by Royce & Associates, led by Chuck Royce, holding a $21 million position; 0.1% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors with similar optimism contain Jim Simons’s Renaissance Technologies, Ken Griffin’s Citadel Investment Group and Ken Fisher’s Fisher Asset Management.

Due to the fact that Knowles Corp (NYSE:KN) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of funds who sold off their positions entirely last quarter. It’s worth mentioning that Matthew Hulsizer’s PEAK6 Capital Management dropped the biggest position of all the hedgies watched by Insider Monkey, totaling about $2.7 million in stock. John Overdeck and David Siegel’s fund, Two Sigma Advisors, also dumped its stock, about $2.6 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Knowles Corp (NYSE:KN). We will take a look at Kraton Corporation (NYSE:KRA), U.S. Physical Therapy, Inc. (NYSE:USPH), WSFS Financial Corporation (NASDAQ:WSFS), and Gran Tierra Energy Inc. (NYSEAMEX:GTE). This group of stocks’ market caps resemble KN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KRA | 22 | 120294 | 0 |

| USPH | 12 | 123509 | 2 |

| WSFS | 10 | 106803 | -2 |

| GTE | 16 | 394926 | 0 |

| Average | 15 | 186383 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $186 million. That figure was $56 million in KN’s case. Kraton Corporation (NYSE:KRA) is the most popular stock in this table. On the other hand WSFS Financial Corporation (NASDAQ:WSFS) is the least popular one with only 10 bullish hedge fund positions. Knowles Corp (NYSE:KN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KRA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.