Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

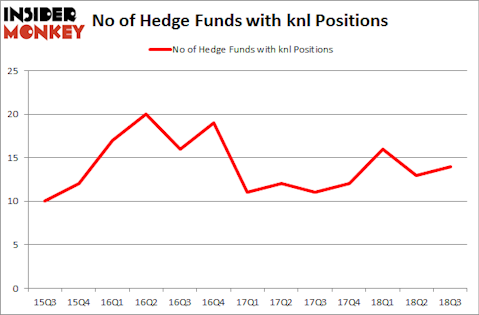

Is Knoll Inc (NYSE:KNL) the right pick for your portfolio? Hedge funds are in a bullish mood. The number of bullish hedge fund positions inched up by 1 in recent months. Our calculations also showed that knl isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are seen as unimportant, outdated investment vehicles of the past. While there are over 8,000 funds in operation at present, Our researchers hone in on the masters of this club, approximately 700 funds. It is estimated that this group of investors manage the lion’s share of the smart money’s total asset base, and by tracking their inimitable picks, Insider Monkey has come up with a number of investment strategies that have historically surpassed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s analyze the latest hedge fund action encompassing Knoll Inc (NYSE:KNL).

What have hedge funds been doing with Knoll Inc (NYSE:KNL)?

Heading into the fourth quarter of 2018, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in KNL at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, D E Shaw held the most valuable stake in Knoll Inc (NYSE:KNL), which was worth $11 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $6.4 million worth of shares. Moreover, Brant Point Investment Management, Renaissance Technologies, and Millennium Management were also bullish on Knoll Inc (NYSE:KNL), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have jumped into Knoll Inc (NYSE:KNL) headfirst. Brant Point Investment Management, managed by Ira Unschuld, assembled the largest position in Knoll Inc (NYSE:KNL). Brant Point Investment Management had $5.8 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.2 million position during the quarter. The following funds were also among the new KNL investors: Matthew Hulsizer’s PEAK6 Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Knoll Inc (NYSE:KNL) but similarly valued. These stocks are National Bank Holdings Corp (NYSE:NBHC), National Western Life Group, Inc. (NASDAQ:NWLI), Piper Jaffray Companies (NYSE:PJC), and Triumph Group Inc (NYSE:TGI). All of these stocks’ market caps are similar to KNL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NBHC | 9 | 97149 | 0 |

| NWLI | 7 | 20438 | -1 |

| PJC | 7 | 48944 | 1 |

| TGI | 7 | 53339 | -1 |

| Average | 7.5 | 54968 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $55 million. That figure was $42 million in KNL’s case. National Bank Holdings Corp (NYSE:NBHC) is the most popular stock in this table. On the other hand National Western Life Group, Inc. (NASDAQ:NWLI) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Knoll Inc (NYSE:KNL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.