After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Knoll Inc (NYSE:KNL).

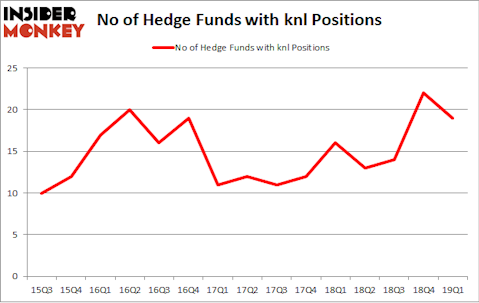

Is Knoll Inc (NYSE:KNL) the right pick for your portfolio? Hedge funds are turning less bullish. The number of bullish hedge fund positions were cut by 3 in recent months. Our calculations also showed that knl isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are dozens of metrics market participants use to evaluate their holdings. Some of the less known metrics are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outclass the market by a significant amount (see the details here).

We’re going to take a look at the key hedge fund action encompassing Knoll Inc (NYSE:KNL).

What does the smart money think about Knoll Inc (NYSE:KNL)?

At Q1’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -14% from the fourth quarter of 2018. On the other hand, there were a total of 16 hedge funds with a bullish position in KNL a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Phill Gross and Robert Atchinson’s Adage Capital Management has the largest position in Knoll Inc (NYSE:KNL), worth close to $15.9 million, comprising less than 0.1%% of its total 13F portfolio. The second most bullish fund manager is D. E. Shaw of D E Shaw, with a $11.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions contain Jim Simons’s Renaissance Technologies, Ken Griffin’s Citadel Investment Group and John Overdeck and David Siegel’s Two Sigma Advisors.

Because Knoll Inc (NYSE:KNL) has witnessed declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few fund managers who sold off their entire stakes by the end of the third quarter. Interestingly, Ken Grossman and Glen Schneider’s SG Capital Management cut the largest stake of all the hedgies monitored by Insider Monkey, valued at about $0.6 million in stock. Noam Gottesman’s fund, GLG Partners, also dumped its stock, about $0.4 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Knoll Inc (NYSE:KNL) but similarly valued. These stocks are Compass Diversified Holdings LLC (NYSE:CODI), Baytex Energy Corp (NYSE:BTE), Retrophin Inc (NASDAQ:RTRX), and Alder Biopharmaceuticals Inc (NASDAQ:ALDR). This group of stocks’ market caps match KNL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CODI | 4 | 4172 | 0 |

| BTE | 10 | 41585 | -2 |

| RTRX | 23 | 363876 | 1 |

| ALDR | 15 | 325409 | 0 |

| Average | 13 | 183761 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $184 million. That figure was $55 million in KNL’s case. Retrophin Inc (NASDAQ:RTRX) is the most popular stock in this table. On the other hand Compass Diversified Holdings LLC (NYSE:CODI) is the least popular one with only 4 bullish hedge fund positions. Knoll Inc (NYSE:KNL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on KNL as the stock returned 4.8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.