At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

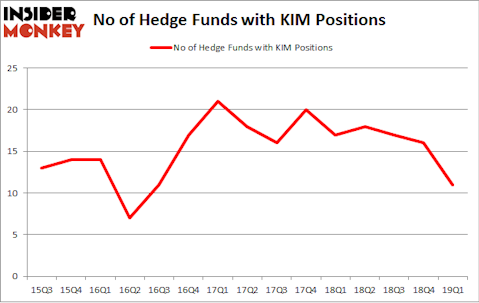

Is Kimco Realty Corp (NYSE:KIM) an outstanding investment today? Prominent investors are taking a bearish view. The number of long hedge fund positions retreated by 5 in recent months. Our calculations also showed that kim isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

We’re going to take a look at the new hedge fund action regarding Kimco Realty Corp (NYSE:KIM).

Hedge fund activity in Kimco Realty Corp (NYSE:KIM)

At the end of the first quarter, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -31% from the fourth quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in KIM a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jim Simons’s Renaissance Technologies has the largest position in Kimco Realty Corp (NYSE:KIM), worth close to $53 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Phill Gross and Robert Atchinson of Adage Capital Management, with a $9.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism contain Jeffrey Talpins’s Element Capital Management, Cliff Asness’s AQR Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

Judging by the fact that Kimco Realty Corp (NYSE:KIM) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of fund managers that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest stake of the 700 funds watched by Insider Monkey, valued at about $14.2 million in stock. Israel Englander’s fund, Millennium Management, also said goodbye to its stock, about $7.9 million worth. These transactions are interesting, as aggregate hedge fund interest was cut by 5 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Kimco Realty Corp (NYSE:KIM) but similarly valued. We will take a look at Omega Healthcare Investors Inc (NYSE:OHI), Oaktree Capital Group LLC (NYSE:OAK), ANGI Homeservices Inc. (NASDAQ:ANGI), and Invesco Ltd. (NYSE:IVZ). This group of stocks’ market caps are similar to KIM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OHI | 13 | 242355 | 2 |

| OAK | 15 | 201018 | 8 |

| ANGI | 22 | 402901 | 0 |

| IVZ | 24 | 172793 | 0 |

| Average | 18.5 | 254767 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $72 million in KIM’s case. Invesco Ltd. (NYSE:IVZ) is the most popular stock in this table. On the other hand Omega Healthcare Investors Inc (NYSE:OHI) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Kimco Realty Corp (NYSE:KIM) is even less popular than OHI. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on KIM, though not to the same extent, as the stock returned 4.7% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.