The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Kaixin Auto Holdings (NASDAQ:KXIN) based on those filings.

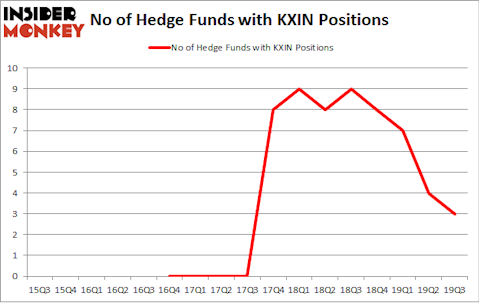

Is Kaixin Auto Holdings (NASDAQ:KXIN) an excellent investment now? Prominent investors are in a pessimistic mood. The number of bullish hedge fund bets went down by 1 recently. Our calculations also showed that KXIN isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Jeffrey Altman of Owl Creek Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the fresh hedge fund action encompassing Kaixin Auto Holdings (NASDAQ:KXIN).

How have hedgies been trading Kaixin Auto Holdings (NASDAQ:KXIN)?

Heading into the fourth quarter of 2019, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from the second quarter of 2019. On the other hand, there were a total of 9 hedge funds with a bullish position in KXIN a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Owl Creek Asset Management was the largest shareholder of Kaixin Auto Holdings (NASDAQ:KXIN), with a stake worth $0.1 million reported as of the end of September. Trailing Owl Creek Asset Management was Bulldog Investors, which amassed a stake valued at $0 million. Centiva Capital was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Bulldog Investors allocated the biggest weight to Kaixin Auto Holdings (NASDAQ:KXIN), around 0.02% of its portfolio. Owl Creek Asset Management is also relatively very bullish on the stock, earmarking 0.01 percent of its 13F equity portfolio to KXIN.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: 683 Capital Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified KXIN as a viable investment and initiated a position in the stock.

Let’s now take a look at hedge fund activity in other stocks similar to Kaixin Auto Holdings (NASDAQ:KXIN). These stocks are Frequency Electronics, Inc. (NASDAQ:FEIM), YRC Worldwide, Inc. (NASDAQ:YRCW), Blue Apron Holdings, Inc. (NYSE:APRN), and Hallador Energy Company (NASDAQ:HNRG). This group of stocks’ market valuations are closest to KXIN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FEIM | 3 | 11359 | 0 |

| YRCW | 6 | 6095 | -2 |

| APRN | 8 | 14612 | 3 |

| HNRG | 9 | 3911 | 0 |

| Average | 6.5 | 8994 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $0 million in KXIN’s case. Hallador Energy Company (NASDAQ:HNRG) is the most popular stock in this table. On the other hand Frequency Electronics, Inc. (NASDAQ:FEIM) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Kaixin Auto Holdings (NASDAQ:KXIN) is even less popular than FEIM. Hedge funds dodged a bullet by taking a bearish stance towards KXIN. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately KXIN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); KXIN investors were disappointed as the stock returned -22.2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.