Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about J. Jill, Inc. (NYSE:JILL).

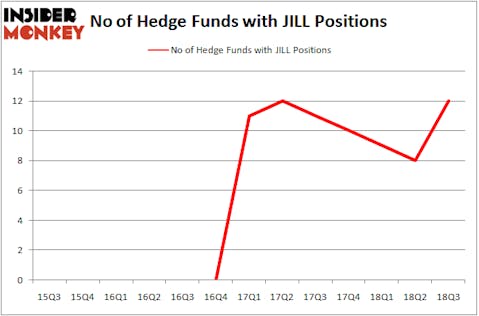

Is J. Jill, Inc. (NYSE:JILL) the right pick for your portfolio? The smart money is becoming hopeful. The number of long hedge fund positions went up by 4 recently. Our calculations also showed that JILL isn’t among the 30 most popular stocks among hedge funds. JILL was in 12 hedge funds’ portfolios at the end of September. There were 8 hedge funds in our database with JILL holdings at the end of the previous quarter.

In the financial world there are a multitude of gauges shareholders employ to assess publicly traded companies. Some of the less known gauges are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best fund managers can outpace the market by a very impressive amount (see the details here).

Let’s take a gander at the new hedge fund action encompassing J. Jill, Inc. (NYSE:JILL).

Hedge fund activity in J. Jill, Inc. (NYSE:JILL)

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 50% from the second quarter of 2018. By comparison, 10 hedge funds held shares or bullish call options in JILL heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Buckingham Capital Management was the largest shareholder of J. Jill, Inc. (NYSE:JILL), with a stake worth $4.8 million reported as of the end of September. Trailing Buckingham Capital Management was Arrowstreet Capital, which amassed a stake valued at $4.2 million. GLG Partners, Coatue Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers have jumped into J. Jill, Inc. (NYSE:JILL) headfirst. Coatue Management, managed by Philippe Laffont, assembled the most valuable position in J. Jill, Inc. (NYSE:JILL). Coatue Management had $0.6 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $0.4 million position during the quarter. The other funds with brand new JILL positions are Paul Marshall and Ian Wace’s Marshall Wace LLP, Joel Greenblatt’s Gotham Asset Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to J. Jill, Inc. (NYSE:JILL). We will take a look at Sify Technologies Limited (NASDAQ:SIFY), Arlington Asset Investment Corp (NYSE:AI), Corindus Vascular Robotics Inc (NYSEMKT:CVRS), and Era Group Inc (NYSE:ERA). This group of stocks’ market caps are similar to JILL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIFY | 1 | 802 | -1 |

| AI | 5 | 11164 | -2 |

| CVRS | 8 | 62250 | 1 |

| ERA | 7 | 45640 | -1 |

| Average | 5.25 | 29964 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.25 hedge funds with bullish positions and the average amount invested in these stocks was $30 million. That figure was $13 million in JILL’s case. Corindus Vascular Robotics Inc (NYSEMKT:CVRS) is the most popular stock in this table. On the other hand Sify Technologies Limited (NASDAQ:SIFY) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks J. Jill, Inc. (NYSE:JILL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.