Trucking, freight, and logistics have faced numerous challenges in the past four years as the pandemic peaked and blocked goods movement. Domestic and global restrictions led to supply chain disruptions.

In 2022, it endured another blow as the geopolitical tension in Europe exacerbated oil supply cuts and price surges. In addition, China implemented a hard lockdown, lowering the global demand. All these contributed to the slow recovery and growth in the industry.

Even so, investors and analysts may be more interested today as the global economy regains its footing. Restrictions have already eased, allowing faster movement of goods and services. Inflation continues to decelerate as oil prices stabilize, leading to increased consumption in 2024. In this article, we will explain why the logistics industry is worth investing in now.

marcin-jozwiak-kGoPcmpPT7c-unsplash

Growth Drivers

The logistics industry is highly cyclical and volatile. It is deeply tied to macroeconomic changes, which can be a double-edged sword to its performance. In the past four years, it has shown its resilience amid massive changes in the aggregate demand in the US. But this year, it sees rosy growth prospects, which several factors may drive.

Decelerating inflation

Inflation appears to be much more stable today. At only 3.4%, it has already dropped by over 60% from the 2022 peak.

If inflation decreases again in the succeeding months, the Fed can meet its target rate of 2%. Even better, it can keep rates unchanged or start cutting interest rates in the second half.

This can be a primary growth driver in the logistics industry. They are capital-intensive companies, so they rely heavily on cash and financial leverage. Lower interest rates also mean lower costs of borrowing, which can help companies maintain or improve their liquidity.

Additionally, lower interest rates can attract more investments and government spending to improve infrastructure and the mobility of goods. This rate can help companies expedite the movement of goods and save more time and money in the long run.

But another important impact of lower interest rates is increased consumer spending and borrowing. They may be enticed to use their credit cards for their discretionary spending, leading to higher production and demand for trucks and ships.

This can lower mortgage rates and entice more people to apply online for a home loan amid the digital revolution. With that, more domestic homeowners will not worry about rental expenses. Also, this can raise spending, leading to more robust production and supply chains.

Digital revolution

The digital revolution enables companies to produce more solutions to streamline business processes. AI and various software are now applicable to transportation and logistics. Many companies aim to use them to track productivity and enhance efficiency.

Companies use transportation software to track the location of their drivers and find the best routes for faster delivery of goods and services. It is also helpful to look for alternative routes in case of road accidents, traffic, and heavy floods. That way, companies can have stable earnings, rain or shine.

Other solutions may generate data analytics, showing the current productivity of workers in the office, warehouse, and on the road.

Increasing Number of Small Business

As of November 2023, 33.2 million small businesses are in the US. These account for 99% of all companies in the country. As the economy regains its footing, 2024 may be the year of sustained recovery and growth. In turn, more robust economic activities may lead to more investments and business openings.

Given this, there may be a higher number of goods and services to be transported domestically and internationally. The logistics industry is at the forefront of it as many buyers and sellers look for same-day delivery couriers.

Even better, the higher number of small businesses means heavier reliance on third-party transportation services. Small businesses do not have adequate network capacity to adjust inventories, cancel orders, and seek alternatives swiftly. Hence, logistics may expect increased demand and revenues.

Pecking Orders

At this point, readers may have already realized why it’s wise to invest in logistics stocks. Despite this, some stocks have been stagnant over the years. Even worse, their financial positioning is a bit risky, which can be another Yellow Corporation in the making. Also, some have limited upside potential despite their size. These are the stocks that are good for buy and sell positions.

Buy: ODFL and JBHT

Old Dominion Freight Line (ODFL) and J.B. Hunt (JBHT) are known US cargo freight logistics companies.

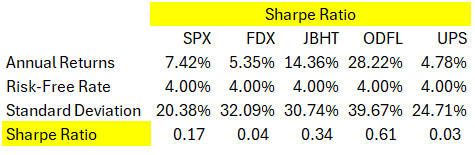

Since the Great Recession, they have given the best returns among the logistics companies on the S&P 500 (SPX) list. ODFL had average annual returns of 28.22%, while JBHT had 14.36%. Their standard deviations exceed the market average, but returns continue to outweigh volatility. Hence, their Sharpe Ratio shows solid risk-return management.

Even better, they have much higher liquidity than UPS and FDX, as shown by their Net Debt/EBITDA Ratio of 0.04x and 0.78x, respectively. They can cover all their borrowings with cash and earnings in less than a year. Additionally, they are far different from Yellow Corporation (YELL), which had a ratio of 7.4x before filing for bankruptcy.

Moreover, both stocks show high upside potential using the DCF Model. The target price for ODFL is $427.95, while JBHT may be $242.53.

Sell: UPS and FDX

UPS and FDX are among the largest logistics companies globally. Yet, returns have been stagnant over the years. UPS had 4.78%, while FDX had 5.35%. Also, their volatility was high, showing that price dips have been offsetting rebounds. As such, they are essentially dead money.

UPS has a decent Net Debt EBITDA Ratio of 1.9x, showing it can cover all its borrowings within one to two years. Yet, it is more than twice as much as JBHT. Meanwhile, FDX has 3.83x, which is risky amid the still elevated interest rates since it is capital-intensive. Their high ratio appears to have partly contributed to the measly stock price returns. With their limited reserves, they also have a limited capacity to increase returns for investors.

Also, both show potential overvaluation using the DCF Model. UPS has a target price of $101.33, or a 51% downside. Meanwhile, FDX has a 20% downside, with $202.02 as the estimated price.

Key Takeaways

The logistics industry has yet to recover fully. Yet, its growth prospects are enticing right now. Investors must be careful, though, to pick the right ones. These excellent stock picks may help them realize huge gains even in the short run.