Baron Funds, an asset management firm, published its “Baron New Asia Fund” first quarter 2022 investor letter – a copy of which can be downloaded here. Baron New Asia Fund (the “Fund”) declined 15.24% (Institutional Shares) during the first quarter of 2022, while its principal benchmark index, the MSCI Asia ex Japan Index, declined 7.99%. Try to spend some time looking at the fund’s top 5 holdings to be informed about their best picks for 2022.

In its Q1 2022 investor letter, Baron New Asia Fund mentioned Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) and explained its insights into the company. Founded in 1987, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is a Hsinchu, Taiwan-based multinational semiconductor contract manufacturing and design company with a $459.8 billion market capitalization. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) delivered a -26.29% return since the beginning of the year, while its 12-month returns are down by -25.01%. The stock closed at $88.68 per share on June 10, 2022.

Here is what Baron New Asia Fund has to say about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q1 2022 investor letter:

“Semiconductor giant Taiwan Semiconductor Manufacturing Company Ltd. detracted in the first quarter due to rising geopolitical tensions, macroeconomic uncertainties, and concerns over softening demand for consumer electronics. We retain conviction that Taiwan Semi’s technological leadership, pricing power, and exposure to secular growth markets, including high-performance computing, automotive, and IoT, will allow the company to deliver above its 15% to 20% revenue growth target over the next several years.”

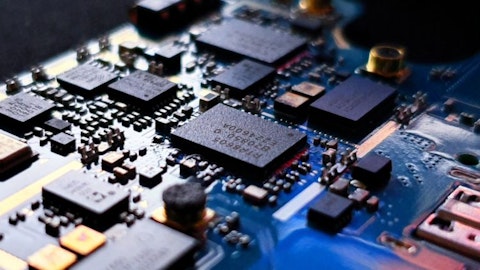

Photo by Yogesh Phuyal on Unsplash

Our calculations show that Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was in 81 hedge fund portfolios at the end of the first quarter of 2022, compared to 72 funds in the previous quarter. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) delivered a -12.55% return in the past 3 months.

In June 2022, we also shared another hedge fund’s views on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.