ClearBridge Investments, an investment management firm, published its “Dividend Strategy” first quarter 2022 investor letter – a copy of which can be downloaded here. The ClearBridge Dividend Strategy outperformed its S&P 500 Index benchmark during the first quarter. On an absolute basis, the Strategy had gains in three of 11 sectors in which it was invested for the quarter. The main contributors to Strategy performance were the energy, industrials, and utility sectors. The materials, IT, and consumer discretionary sectors, meanwhile, were the main detractors. Try to spend some time taking a look at the fund’s top 5 holdings to be informed about their best picks for 2022.

In its Q1 2022 investor letter, ClearBridge Investments Dividend Strategy mentioned Northrop Grumman Corporation (NYSE:NOC) and explained its insights for the company. Founded in 1994, Northrop Grumman Corporation (NYSE:NOC) is a Falls Church, Virginia-based multinational aerospace and defense technology company with a $72.7 billion market capitalization. Northrop Grumman Corporation (NYSE:NOC) delivered a 20.70% return since the beginning of the year, while its 12-month returns are up by 35.58%. The stock closed at $467.20 per share on April 14, 2022.

Here is what ClearBridge Investments Dividend Strategy has to say about Northrop Grumman Corporation (NYSE:NOC) in its Q1 2022 investor letter:

“Our material overweight to aerospace and defense (~5% in Dividend Strategy vs ~1.5% in the index) was another large contributor to performance in the quarter. Northrop Grumman (NYSE:NOC) performed well. Our investment in the company was obviously not predicated on war breaking out in Europe. Rather, they both embody many of the core attributes we look for in all our companies. The company have favorable long-term growth outlooks that should enable them to compound earnings and dividends for years to come.

Northrop Grumman is a more recent addition to the portfolio. We started following it closely in late 2019 based on the strength of its product portfolio. While we immediately liked the company and the story, the valuation did not initially screen well. Defense stocks sold off around the 2020 election as investors worried that a Democratic administration would result in weaker defense spending. We found that interpretation misguided and took advantage of the selloff to build a position. Last month, as defense stocks surged post Russia’s attack, we trimmed our Northrop position. While we continue to like the company, we believe the recent run in the shares appropriately discounts the higher level of defense spending we now expect to see.”

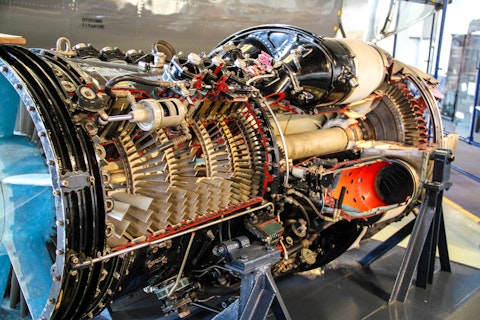

Ruslans Golenkovs/Shutterstock.com

Our calculations show that Northrop Grumman Corporation (NYSE:NOC) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. Northrop Grumman Corporation (NYSE:NOC) was in 33 hedge fund portfolios at the end of the fourth quarter of 2021, compared to 29 funds in the previous quarter. Northrop Grumman Corporation (NYSE:NOC) delivered a 17.50% return in the past 3 months.

In March 2021, we published an article that includes Northrop Grumman Corporation (NYSE:NOC) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.