ClearBridge Investments, an investment management firm, published its “Sustainability Leaders Strategy” first quarter 2022 investor letter – a copy of which can be downloaded here. The ClearBridge Sustainability Leaders Strategy underperformed its Russell 3000 Index benchmark during the first quarter. On an absolute basis, the Strategy had gains in one of 10 sectors in which it was invested (out of 11 sectors total) – the utilities sector. The main detractors were the information technology (IT), consumer discretionary and industrials sectors. Try to spend some time taking a look at the fund’s top 5 holdings to be informed about their best picks for 2022.

In its Q1 2022 investor letter, ClearBridge Investments Sustainability Leaders Strategy mentioned TE Connectivity Ltd. (NYSE:TEL) and explained its insights for the company. Founded in 2000, TE Connectivity Ltd. (NYSE:TEL) is a Schaffhausen, Switzerland-based consumer electronics company with a $41.0 billion market capitalization. TE Connectivity Ltd. (NYSE:TEL) delivered a -21.09% return since the beginning of the year, while its 12-month returns are down by -6.73%. The stock closed at $127.31 per share on May 06, 2022.

Here is what ClearBridge Investments Sustainability Leaders Strategy has to say about TE Connectivity Ltd. (NYSE:TEL) in its Q1 2022 investor letter:

“The acceleration in electrification of transport should support electric vehicle (EV)-related stocks like TE Connectivity (NYSE:TEL), which came under pressure in the quarter on concerns the auto cycle is past its peak. TE Connectivity makes connectors for a wide range of uses, from automobiles to data centers and medical devices. The large exposure of TEL to EVs should lead to long-term value as EVs continue their growth, boosted by their relative attractiveness as prices at the pump hit near-historic highs.”

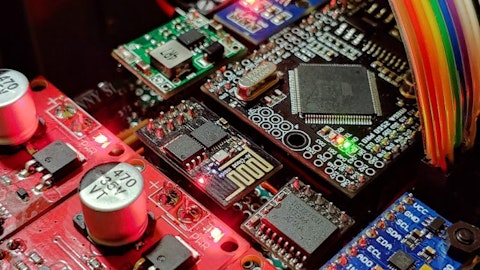

electronics-6055226_1280

Our calculations show that TE Connectivity Ltd. (NYSE:TEL) fell short and didn’t make it on our list of the 30 Most Popular Stocks Among Hedge Funds. TE Connectivity Ltd. (NYSE:TEL) was in 41 hedge fund portfolios at the end of the fourth quarter of 2021, compared to 41 funds in the previous quarter. TE Connectivity Ltd. (NYSE:TEL)delivered a -11.20% return in the past 3 months.

In April 2022, we also shared another hedge fund’s views on TE Connectivity Ltd. (NYSE:TEL) in another article. You can find other investor letters from hedge funds and prominent investors on our hedge fund investor letters 2022 Q1 page.

Disclosure: None. This article is originally published at Insider Monkey.