Brasada Capital Management, an investment management company, released its Q2,2022 Investor Letter, a copy of which can be downloaded here. The fund returned -25.7% net of fees for the first half of the year. An increase in the 10-year treasury yield leads to a decline in the multiples on investment assets. Check out the top 5 holdings of the fund to have a glimpse of its finest picks for 2022.

In the Q2, 2022 investor letter Brasada Capital Management analyzed Azenta, Inc. (NASDAQ:AZTA) and consider this a recession-resistant stock. Azenta, Inc. (NASDAQ:AZTA), founded in 1978, provides cold-chain sample management solutions and genomic services and has a market capitalization of $4.798 billion. Azenta, Inc. (NASDAQ:AZTA) was down -11.76% on a monthly time frame, while its 12-month returns plunged to -27.66%. The stock closed at $63.98 per share on July 25, 2022.

In Q2, 2022, here is what the fund specifically said about Azenta, Inc. (NASDAQ:AZTA):

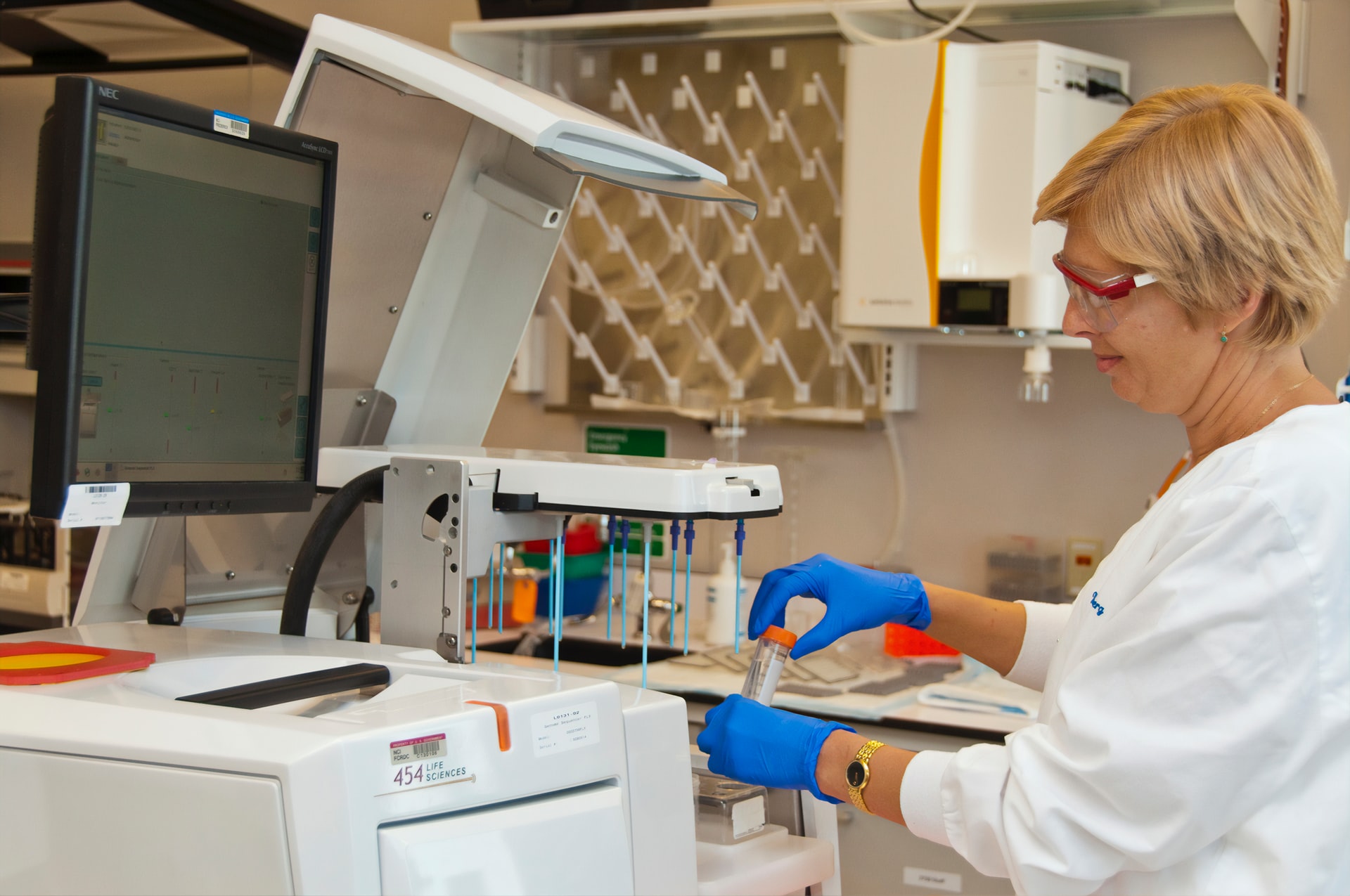

“Azenta is a new name for us. The company provides biological sample storage management solutions and genomics services to biopharma firms as well as large clinic academic systems and academic researchers. Biological samples are important sources of information to develop new therapies as well as more complex Cell and Gene Therapies as well as individualized treatments. The acceleration of research and development towards Cell and Gene Therapies and mRNA vaccines requires large scale cold storage, which is Azenta’s specialty. Today there are 9 FDA approved Cell and Gene Therapies and over 1,000clinical trials. Azenta also offers genomic sequencing through its Genewiz subsidiary. This is a service that they can cross sell to existing sample storage management customers.”

Their core markets are expected to grow 15%-20% per annum for the next five years. Given Azenta’s leading market position in automated sample storage, we expect them to take share from competitors and their customers, who are increasingly outsourcing non-core operations…” (Click here to see the full text)

Although Brasada Capital Management is invested in Azenta, Inc. (NASDAQ:AZTA), the stock isn’t in the list of 30 Most Popular Stocks Among Hedge Funds . At the end of Q1 2022 Azenta, Inc. (NASDAQ:AZTA) was in 25 hedge fund portfolios compared to 33 in Q4,2021. Azenta, Inc. (NASDAQ:AZTA) shares lost 27.75% of their value over the last 52 weeks.

In February we published an article on why to include Azenta, Inc. (NASDAQ:AZTA) in the long-term pick. If you want to read more investor letters from hedge funds and other leading investors, check out our hedge fund investor letters 2022 page.

Disclosure: None. This article is originally published at Insider Monkey.