You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hedge fund interest in iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cognex Corporation (NASDAQ:CGNX), Newell Brands Inc. (NYSE:NWL), and SEI Investments Company (NASDAQ:SEIC) to gather more data points.

In the 21st century investor’s toolkit there are tons of signals shareholders have at their disposal to evaluate their stock investments. A duo of the most under-the-radar signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can trounce their index-focused peers by a solid amount (see the details here).

We’re going to analyze the new hedge fund action encompassing iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB).

How are hedge funds trading iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB)?

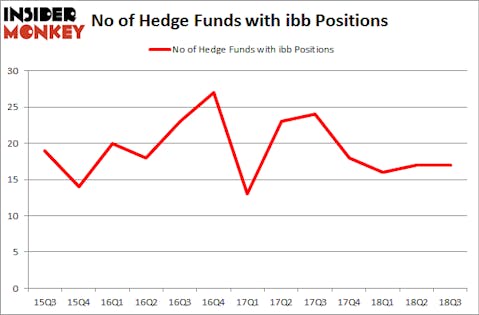

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, no change from the second quarter of 2018. By comparison, 18 hedge funds held shares or bullish call options in IBB heading into this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Duquesne Capital held the most valuable stake in iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB), which was worth $126 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $61.9 million worth of shares. Moreover, Millennium Management, Citadel Investment Group, and Two Sigma Advisors were also bullish on iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB), allocating a large percentage of their portfolios to this stock.

Seeing as iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB) has faced declining sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that slashed their entire stakes last quarter. It’s worth mentioning that Kenneth Tropin’s Graham Capital Management cut the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $5.5 million in stock. Sander Gerber’s fund, Hudson Bay Capital Management, also sold off its stock, about $5.2 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as iShares Nasdaq Biotechnology ETF (ETF) (NASDAQ:IBB) but similarly valued. These stocks are Cognex Corporation (NASDAQ:CGNX), Newell Brands Inc. (NYASDAQ:NWL), SEI Investments Company (NASDAQ:SEIC), and Lear Corporation (NYSE:LEA). This group of stocks’ market caps resemble IBB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CGNX | 13 | 272086 | -3 |

| NWL | 36 | 1698839 | 3 |

| SEIC | 24 | 360985 | 2 |

| LEA | 34 | 845180 | 2 |

| Average | 26.75 | 794273 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $794 million. That figure was $191 million in IBB’s case. Newell Brands Inc. (NASDAQ:NWL) is the most popular stock in this table. On the other hand Cognex Corporation (NASDAQ:CGNX) is the least popular one with only 13 bullish hedge fund positions. iShares Nasdaq Biotechnology ETF (NASDAQ:IBB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NWL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.